27 October 2021

BBVA acted as joint bookrunner in CK Hutchison’s dual-tranche 8 & 12 years bond transaction

BBVA, acting as Joint-Bookrunner, has been involved in the dual-tranche 8 & 12 years bond transaction by CK Hutchison, being the latter the company's inaugural Green Bond.

|

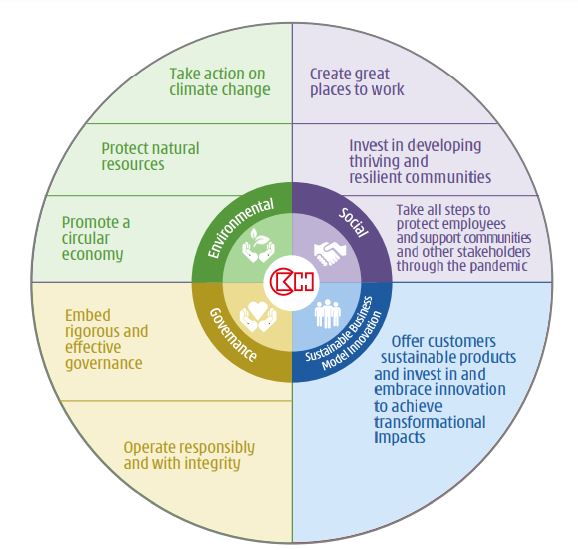

Group Sustainability Framework Group Sustainability Framework |