07 September 2021

BBVA has led the inaugural 20 year Green Bond transaction by the Kingdom of Spain acting as Green Structuring Bank and Active Bookrunner.

|

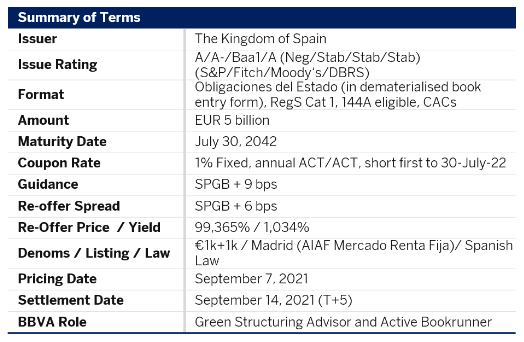

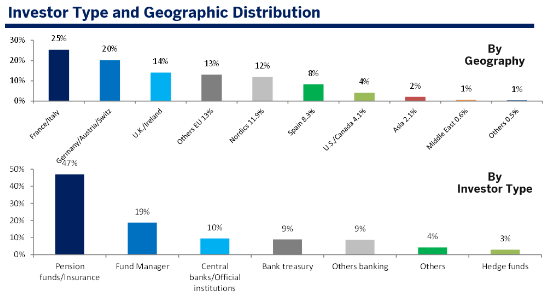

BBVA, acting as Green Structuring Bank and Active Bookrunner, has been involved in the inaugural 20 year green bond transaction from the Kingdom of Spain. Acting through the Spanish Treasury, the Kingdom of Spain successfully priced EUR 5 billion 1% notes due July 2042 at a spread of SPGB + 6 bps (1.034% yield to maturity) with participation from 465 national and internal investors.

The transaction was launched at SPGB + 6 bps as a result of demand exceeding EUR 60 billion at peak (including EUR 3.4 bn JLM interest) following guidance of SPGB + 9 bps area.

Already back in July on the 29th the Kingdom of Spain held a Global Investor Call presenting its new Green Bond Framework to investors. The Framework is fully aligned with the Green Bond Principles of the International Capital Markets Association (ICMA GBP 2021) and a Second Party Opinion has been prepared by Vigeo Eiris (V.E). |

|

|

EUR 5 billion 20-year inaugural green bond priced at SPGB + 6 bps. Strong execution metrics with a greenium of 2 bps and over 12x oversubscribed orderbook at peak (highest oversubscription in an inaugural green bond syndication from any European sovereign). 2/3 SRI focus investors. |

|

Transaction Highlights

- The transaction follows the release of the Kingdom of Spain’s Green Bond Framework during the summer. The Framework is fully aligned with the Green Bond Principles of the International Capital Markets Association (ICMA GBP 2021) and a Second Party Opinion has been prepared by Vigeo Eiris (V.E). According to the second party opinion by Vigeo Eiris, Spain’s Green Bond Framework meets the highest possible standards and gets the highest rating ever given to a European sovereign. Overall, the Kingdom has identified EUR 13.6bn of eligible expenditures over the 2018-2021 period.

- On Thursday 29th July 2021, the Kingdom of Spain held a Global Investor Call (GIC) to present its new Green Bond Framework to investors.

- The mandate for an Inaugural Green SPGB with a July 2042 maturity was announced on Monday 6th September at 14:15 CET, with the aim to price the transaction on Tuesday 7th.

- Despite the absence of any pricing indications, the debut Green Bond was met with strong enthusiasm from investors during the rest of the day and overnight, with IoIs standing in excess of EUR 38.5bn (incl. EUR 3.4bn JLM trading interest) when books officially opened with guidance at SPGB 10/40 +9bps area on Tuesday morning.

- Momentum remained strong, with demand reaching over EUR 60 bn (incl. EUR 3.4bn JLM trading interest) within 1 hour of books opening, allowing for the guidance to be revised to SPGB 10/40 +7bps.

- The final spread was set at SPGB 10/40 +6bps at 11:30 CET and books closed shortly after with a final size above EUR 60bn (incl. EUR 3.4bn JLM trading interest) and the participation from 465 accounts. As a result, the issuance was 12 times oversubscribed, the highest oversubscription in an inaugural green bond syndication from any European sovereign.

- The transaction priced at SPGB 10/40 +6bps, implying a reoffer yield of 1.034%. At this level, the leads estimated that the transaction achieved a greenium of around 2bps.

- The Inaugural Green SPGB benefitted from a strong support from Green investors, which received more than 2/3 of the amount allocated.

Use of Proceeds