Green and Sustainability-Linked Loan

February 2025

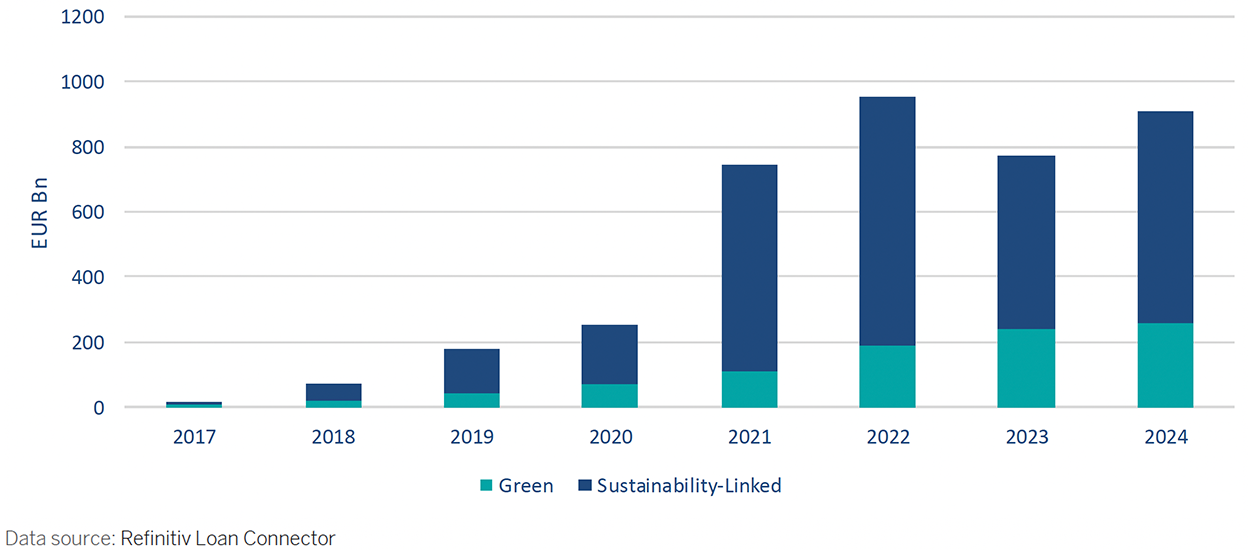

The sustainable loan market demonstrated robust growth in 2024, reaching EUR 907Bn globally – an increase of 17% compared to the same period in 2023.

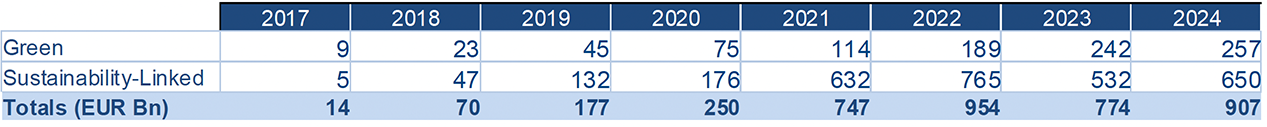

Sustainability-linked loans once again dominated the market, accounting for EUR 650Bn or 72% of the total sustainable loan volume. Sustainability-linked loans saw a significant year-over-year increase of 22%. In contrast, green loans experienced a more modest expansion, with volumes rising by 6% compared to 2023.

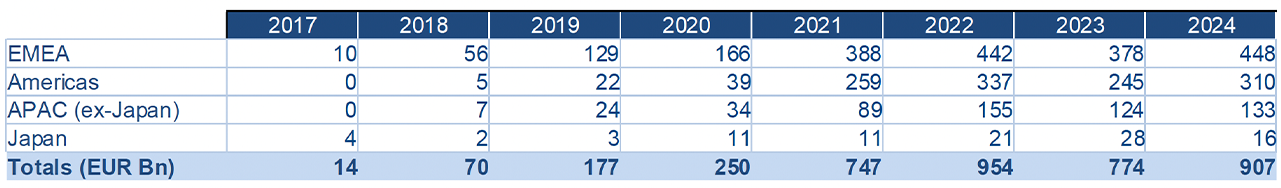

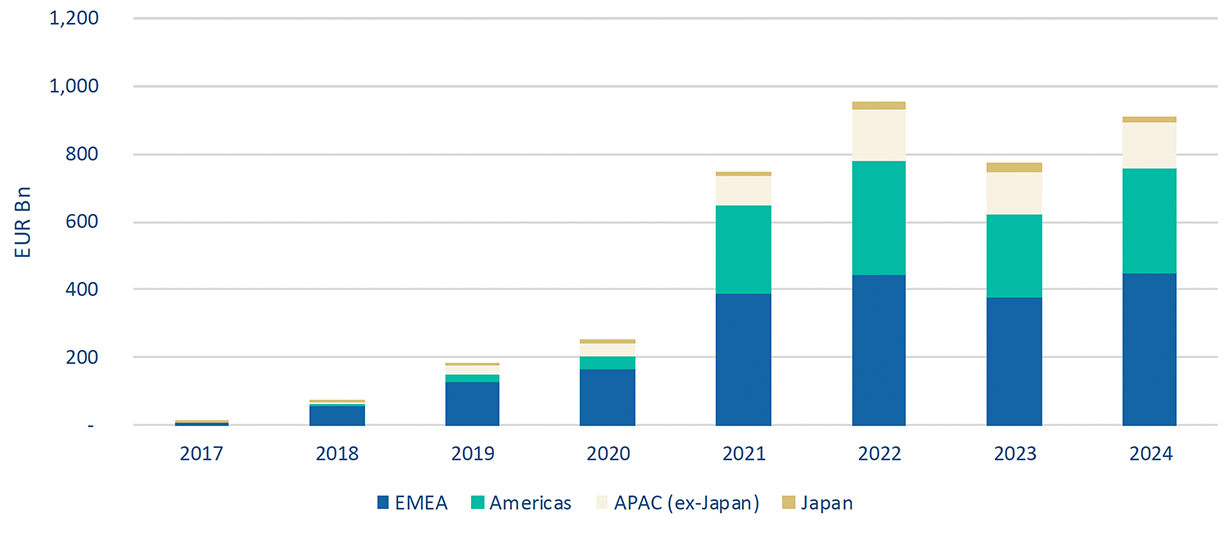

EMEA remained the leading region for sustainable loans, recording EUR 448Bn in total volume-49% of the global sustainable loan market and a 19% increase from 2023. The Americas followed, representing 34% of the market with EUR 310Bn. The region also posted the highest growth rate globally, with a 27% increase year-over-year. Together, EMEA and the Americas accounted for 84% of total sustainable loan issuance in 2024. APAC concluded the year with EUR 133Bn, reflecting an 8% increase, a more moderate pace compared to EMEA and the Americas. Japan was the only major market to decline, with sustainable loan volumes falling by 44% to EUR 16Bn in 2024.

The sustainable loan market demonstrated robust growth in 2024, reaching EUR 907Bn globally – an increase of 17% compared to the same period in 2023.

Find here 2024 Sustainability-linked loans highlights.

Highlights of 3Q2024

CSRD Directive

One of the extended claims in relation to the various aspects of sustainability performance of the corporates has always been the standardization of the info, methodologies,reports.

Anti-Greenwashing regulations on the horizon

Contributing to the ongoing development of regulations, evolving standards, and recommendations within the sustainability space, the UK's FCA introduced its anti-greenwashing rule, effective as of 31st May 2024.

• Sustainability-linked loan market

Labeling sustainability-linked financing granted to high emission companies and sectors has certainly become more scrutinized, raising concerns over the materiality of the KPIs and the ambition of the SPTs

ICMA's new guidelines on Green, Social and Sustainability-linked Bonds Principles

By the end of June 2024, ICMA released new materials and further guidelines to support the referred Bond Principles. The new developments would create both a new financing opportunity in the debt capital markets while also aiming to support the integrity of sustainability-linked financing.

BBVA Top Deals – 3Q2024

![]()

Top Deals

TOP DEALS

Project Campillo II, Spain

EUR 36.7 Mn

Bilateral Green Loan

[BBVA, Sole Green Loan Coordinator.]

Project Centro Comercial Jaen Plaza, Spain

EUR 51 Mn

Green Loab

[BBVA, Sole Green Loan Coordinator.]

Polestar, UK

(Unrated)

EUR 340 Mn and USD 538 Mn

Syndicated Green Corporate Loan

[BBVA, Joint Green Loan Lead Coordinator.]

Project Ellis Solar, USA

USD 30.4 Mn

Bilateral Green Loan

[BBVA, Sole Green Loan Coordinator.]

Project Monegros, Spain

ç

EUR 383 Mn

Green Loan

[BBVA, Sole Green Loan Coordinator.]

Hyundai Capital Services, South Korea

(BBB+/Baa1/BBB+)

EUR 100 Mn

first overseas Green Loan

[BBVA, Green Loan Structurer.]

Ecoener, Spain

(Unrated)

EUR 105 Mn

Green Loan

[BBVA, Global & Sustainability Coordinator.]

CEMEX, S.A.B. de C.V., Mexico

(BBB-/-/BBB-)

EUR 750 Mn

KPI linked

[BBVA, Sustainability Coordinator.]

DeAcero, Mexico

(Unrated)

USD 200 Mn

Green Bilateral Facility

[BBVA, Sustainability Coordinator.]

Project 3-Pack (Daybreak & Ranger), USA

USD 2,310 Mn

Green Loan

[BBVA, Green Loan Coordinator.]

Tages Net Zero, Italy

EUR 620 Mn

Green Loan

[BBVA, Green Loan Coordinator.]

Inmobiliaria Colonial, Socimi, S.A. , Spain

(BBB+/-/-)

EUR 1 Bn

KPI linked

[BBVA, Sustainability Coordinator.]

Sonnedix Kandle, Italy

EUR 285 Mn

Green Loan

[BBVA, Green Loan Coordinator.]

EnBW, Germany

(A-/Baa1/-)

EUR 2 Bn

Sustainability-linked RCF

[BBVA, Global & Sustainability Coordinator.]

Grupo Antolín-Irausa, Spain

(Unrated)

EUR 185 Mn

Sustainability-linked

[BBVA, Sustainability Coordinator.]

Magnon Green Energy, Spain

EUR 190 Mn

Green Loan

[BBVA, Green Loan Coordinator.]

Project Wagon Wheel, USA

EUR 1,173.5 Mn

Green Loan

[BBVA, Green Loan Coordinator.]

Project Javelin, USA

USD 942 Mn

Green Loan

[BBVA, Green Loan Coordinator.]

Project Milano & Guadacano, Spain

EUR 55.8 Mn

Green Loans

[BBVA, Sole Green Loan Coordinator.]

Hotel Four Seasons CDMX + Mayakoba, Mexico

USD 480 Mn

Green Loans

[BBVA, Green Loan Coordinator.]

Project 2-Pack (Kelvin & Current), USA

USD 911 Mn

Green Loan

[BBVA, Green Loan Coordinator.]

WP Carey, US

(BBB+/Baa1)

USD 2 Bn

Sustainability-linked

[BBVA, Co-Sustainability Structuring Agent.]

Minera Ares in Peru and Amarello Mineracao in Brazil are part of Hochschild Group

(BBB-)

USD 300 Mn

Sustainability-linked

[BBVA, Bookrunner & Sustainability Co-Coordinator.]

McBride, UK

(Unrated)

EUR 200 Mn

Sustainability-linked RCF

[BBVA, Sole Sustainability Coordinator.]

Project Lazbuddie Wind, USA

USD 502 Mn

Green Loan

[BBVA, Green Loan Coordinator.]

Project Opde Helios 2 PV, Spain

EUR 218 Mn

Green Loan

[BBVA, Green Loan Coordinator.]

Colbun, Chile

(BBB, Baa2, BBB+)

USD 300 Mn

Green Loan

[BBVA: Bookrunner and Sole Green Loan Coordinator.]

Palladium Hotel Group, Spain

EUR 200 Mn

Sustainability-Linked RCF

[BBVA: Sole Bookrunner, Coordinator, Sustainability Coordinator, MLA & Agent.]

Corporación Inmobilaria Vesta, Mexico

(BBB-1)

USD 550 Mn

Green Loan

[BBVA: Joint Bookrunner and Sustainability Agent.]

Nemak, Mexico

(BBB-2)

USD 200 Mn

Sustainability-Linked Loan

[BBVA: Joint Bookrunner and Green Loan Coordinator.]

Sustainable loan volumes per geography

Sustainable loan volumes per type of instrument

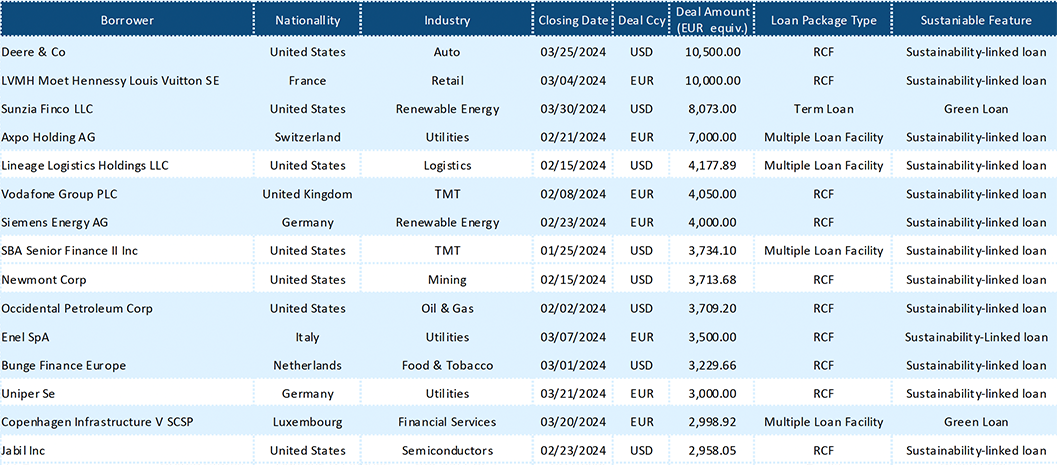

Selected Sustainable Loans – 3Q2024

Disclaimer

This document is provided with an informative purpose, having the information contained herein merely the character of an example. Such information does not constitute an offer to finance or to purchase or sell securities or any specific tax, legal, environmental, social, accounting or regulatory advice or recommendation of whatever form. Clients should independently evaluate the financial, environmental, social, market, legal, regulatory, credit, tax and accounting risks and consequences and should not rely on Banco Bilbao Vizcaya Argentaria, S.A., or any of its Group entities (hereinafter “BBVA”) for this.

The information contained herein is information available from public sources. Information on ESG trends is based on BBVA’s understanding of certain current market practices, which may differ among markets and over time and/or may be amended or replaced by legally binding regulations. Notwithstanding the fact that reasonable measures to assure that the information contained herein is not mistaken or misleading, BBVA does not represent or warrant, either express or implicit, its accuracy, integrity or correctness and therefore no party should rely on it. BBVA accepts no liability for any mistake or omission in the information nor any obligation to communicate any changes to this document or to update its contents. Clients should voluntarily and independently assess any information contained herein and are solely responsible for relying on it and for the decision to execute a particular transaction and for complying with recognized markets standards, any applicable laws, regulations and obligations to that effect.

Consequently, neither BBVA nor any of its officers, directors or employees accept any responsibility or obligation nor will have any liability whatsoever for any loss, damage or claim of any kind, arising from or in relation to the information provided by BBVA or any action taken in reliance thereon, in or from any jurisdiction, including but not limited to the present or future consideration of any transaction as sustainable.

This document is property of BBVA. Any denominations, designs, and logos are registered trademarks of BBVA. The information contained herein is provided to you by BBVA on a strictly confidential basis. No part of this document may be copied, conveyed, distributed or furnished to any person or entity without the consent of BBVA. Specifically, no part of this document may be copied, conveyed or distributed into the United States of America or furnished to any person or entity in the United States or any US person. Failure to comply with these restrictions may breach the laws of the US. It is understood that its recipients accept all of the warnings and conditions contained herein in its integrity.

This document has not been drafted according to the rules in place for the independence of investment reports, thus it does not contain objective explanations, nor has it been independently verified.

For further information or help on the website, please contact our BBVA CIB Marketing department or the Debt Capital Markets team:

This document is provided with an informative purpose, having the information contained herein merely the character of an example. Such information does not constitute an offer to finance or to purchase or sell securities or any specific tax, legal, environmental, social, accounting or regulatory advice or recommendation of whatever form. Clients should independently evaluate the financial, environmental, social, market, legal, regulatory, credit, tax and accounting risks and consequences and should not rely on Banco Bilbao Vizcaya Argentaria, S.A., or any of its Group entities (hereinafter “BBVA”) for this.

The information contained herein is information available from public sources. Information on ESG trends is based on BBVA’s understanding of certain current market practices, which may differ among markets and over time and/or may be amended or replaced by legally binding regulations. Notwithstanding the fact that reasonable measures to assure that the information contained herein is not mistaken or misleading, BBVA does not represent or warrant, either express or implicit, its accuracy, integrity or correctness and therefore no party should rely on it. BBVA accepts no liability for any mistake or omission in the information nor any obligation to communicate any changes to this document or to update its contents.

Clients should voluntarily and independently assess any information contained herein and are solely responsible for relying on it and for the decision to execute a particular transaction and for complying with recognised markets standards, any applicable laws, regulations and obligations to that effect.

Consequently, neither BBVA nor any of its officers, directors or employees accept any responsibility or obligation nor will have any liability whatsoever for any loss, damage or claim of any kind, arising from or in relation to the information provided by BBVA or any action taken in reliance thereon, in or from any jurisdiction, including but not limited to the present or future consideration of any transaction as sustainable.

This document is property of BBVA. Any denominations, designs, and logos are registered trademarks of BBVA. The information contained herein is provided to you by BBVA on a strictly confidential basis. No part of this document may be copied, conveyed, distributed or furnished to any person or entity without the consent of BBVA. Specifically, no part of this document may be copied, conveyed or distributed into the United States of America or furnished to any person or entity in the United States or any US person. Failure to comply with these restrictions may breach the laws of the US. It is understood that its recipients accept all of the warnings and conditions contained herein in its integrity.

This document has not been drafted according to the rules in place for the independence of investment reports, thus it does not contain objective explanations, nor has it been independently verified.