28 July 2023

BBVA CIB Achieves Record Revenues of 1.405 Billion Euros in Second Quarter

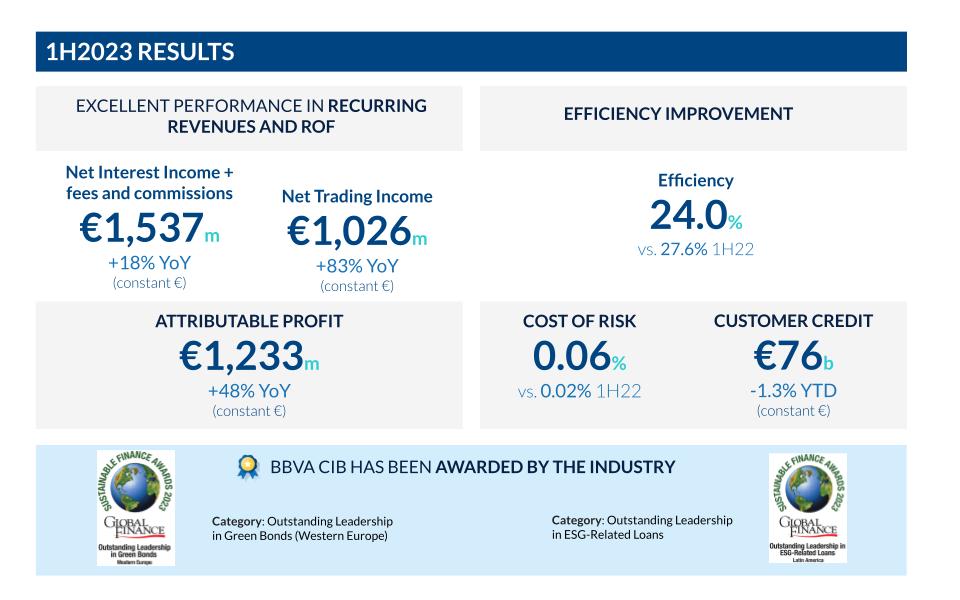

- BBVA CIB achieves accumulated net attributable profit of 1.233 billion euros in the first half of 2023, a year-on-year growth of 48% (in constant euros and does not reflect the application of hyperinflation accounting).

- The highlight of the quarter is the growth in revenues, which reached 1.405 billion euros in the period between March and June, 54% more than in the same period of 2022.

- Growth in all business units, especially in Global Markets, mainly in the United States and Emerging Markets, the contribution of Global Transaction Banking in all geographies, and Project Finance in Investment Banking & Finance.

- Improvement in the efficiency ratio, which stands at 24.0%, and increase in the profitability of the businesses.

BBVA CIB's earnings for the second quarter of the year reflect the contribution of the diversification of products and geographies and the area's progress in developing its strategy, leveraged on globality and sustainability, aiming to be relevant for its customers. Despite a highly uncertain macroeconomic context, certain dynamics make the outlook for BBVA CIB's business positive. All divisions achieved good results with the performance of Global Markets, mainly in the United States and Emerging Markets, with the contribution of Global Transaction Banking in all geographies and Project Finance in Investment Banking & Finance being particularly noteworthy. Attention should be paid to the growth in investment in all geographies, which continues to be slower than expected.

Business units performance

Excellent quarter for Global Markets, highlighting the FX business in all geographies where BBVA operates, with an extraordinary contribution from Emerging Markets. Also noteworthy is the excellent performance of the Rates' business in South America and growth in the United States.

Global Transaction Banking (GTB) has once again achieved record revenue figures in the last quarter, surpassing even the impressive results of the first quarter of 2023. Interest rate hikes were once again the main driver of the improvement in revenues, with a solid performance in net interest income compared to the same period of the previous year. However, there are still challenges in financing activity. It is important to highlight the growth in transactional activity with our customers, which increased our commission income dramatically.

Investment Banking & Finance (IB&F) achieved a good performance in revenues in most of our geographies, with outstanding growth in Project Finance, despite an environment marked by the contraction in global demand for credit in the first half of the year, which led to a significant slowdown in most business segments.

Rising interest rates have limited syndicated loan transactions, while financing volumes driven by M&A activity have been negatively affected. Corporate finance markets also face macroeconomic and political uncertainties, with a sharp decline in activity in most geographies. Nevertheless, IB&F has had a remarkable performance in Advisory's activity compared to the same period of the previous year. Geographically, record results were obtained in the first half of the year, thanks to the strong growth in Corporate Lending and, mainly in Project Finance, with the closing of several outstanding operations in energy and infrastructure, in which BBVA played a leading role.

A geographically diversified business

The geographic diversification of CIB's revenues continues to be one of the main pillars of creating value for the Group. At the end of June 2023, the contribution to CIB's accumulated net attributable profit was as follows: 16% Spain, 24% Mexico, 30% Turkey, 14% South America and 16% Rest of Business (Asia, USA and Rest of Europe).

Additionally, we continue to work on generating value propositions for our customers, such as the eCommerce platform launched in Mexico, which will allow us to continue strengthening GTB's business, as well as the focus on increasing our customer base, where we have had a booming growth in the number of new subsidiaries and Equity distributors in the USA.

Adoption of new trends

At BBVA CIB, we continue to drive innovation by adopting new trends; proof of this is that we have been pioneers in offering crypto solutions to our clients, with the first issue of a digital bond in Spain issued by IDB with Bolsas y Mercados Españoles.

BBVA CIB continues to receive recognition from the industry

As a result of its commitment to sustainability, BBVA has been recognized by Global Finance for its leadership in sustainability-related lending in Latin America and for its leadership in green bond activity in Western Europe.

These recognitions join those announced by Global Finance at the beginning of the half year. BBVA was named best investment bank in Spain, Mexico and Argentina in 2023. In the transactional banking area, it has also been recognized as the best provider of Treasury and Cash Management services in Peru and Spain and as the best payments and collections bank in Latin America in 2023.