31 October 2024

BBVA CIB achieves record revenues of €4,295 between January and September

- Growth in loans and receivables, thanks to the favorable performance of Project Finance, Corporate Lending, and the transactional business.

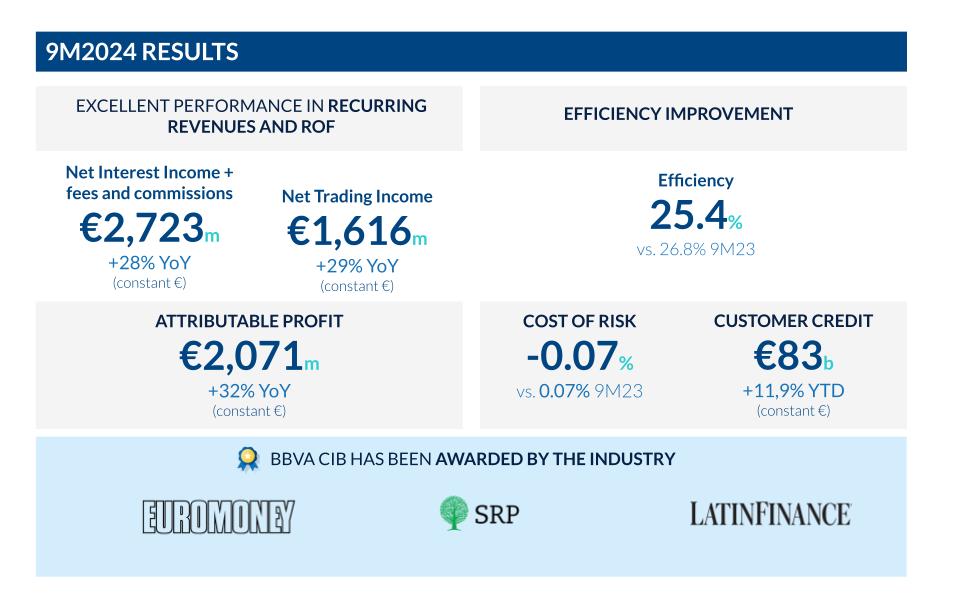

- CIB's revenues reached €4,295 million, 29% up from the same period in 2023 (in constant euros and do not include the application of the hyperinflation adjustment in the accounting records).

- All business units growing at double digits: Global Markets +26% year-on-year, supported by good commercial activity, including good results in Credit in Europe as well as Equity in the USA and Mexico; GTB +34% year-on-year, thanks to the positive performance of recurring revenues and IB&F +28% year-on-year, excellent activity in Project Finance and Corporate Lending, benefiting net interest income and commissions.

- As for net attributable profit, BBVA CIB achieved a profit of €2,071 million, with a year-on-year increase of +32%.

- Increased business profitability, especially in Spain, the USA and Mexico.

BBVA Corporate & Investment Banking achieved revenues of €4,295 million by September 2024, an increase of 29% over the same period in 2023. In turn, the company's investment banking division stood out with a net attributable profit of €2,071 million, up 32% from the same period last year. With these figures, BBVA CIB contributes 15% to the Group's gross income, reinforcing its strategic positioning as an important pillar of growth for the coming years.

BBVA CIB aims to continue developing an efficient and profitable franchise globally. Its strategy is based on globality and geographic diversification, with a particular focus on the United States, the United Kingdom, Europe, Brazil and Asia, where it will continue to invest in building new product capabilities and strengthening coverage teams. In addition, the business will seek to increase its relevance to institutional and corporate clients, focusing on a specialized sector approach. All with the goal of tailoring solutions to the specific needs of each industry, while maintaining sustainability as a cornerstone of the wholesale banking value proposition on a global scale.

Business unit performance

Global Markets (GM) achieved outstanding results in the third quarter, with a significant contribution from Rates activity (Emerging Markets and G10), and excellent activity with clients in the United States and Europe. Solid performance was also seen in the Equity and FX segments, driven by growth in the digital business and multiple awards for the cross-asset platform of investment products.

In addition, Global Transaction Banking (GTB) had the best quarter in its history, with record revenues, bringing the year-to-date total to €1,759 million, up 34% from the same period last year. Despite the first interest rate cuts in Europe and the United States, the transaction business remains resilient and continues to perform solidly. Activity continues to show strength, with volumes of loans, deposits and guarantees at record highs at the end of September. There was also strong momentum in trade finance and institutional client activity. This is the second consecutive quarter with record revenues, reaching €615 million in this last period. Finally, fee and commission income continued to grow at a double-digit rate, reinforcing the unit's revenue recurrence without forgetting the efficiency gains that continued to progress during the quarter.

Investment Banking & Finance (IB&F) reported excellent results for the first nine months of the year, with record revenues of €855 million, an increase of 28% over the previous year. This increase was achieved mainly through activities in Spain, the rest of Europe and the United States, with syndicated loans reaching the 2021 volume level. There was excellent performance in corporate lending and Project Finance, areas in which BBVA is a leader in its main regions. In terms of market performance, the recovery in global corporate lending continued, offsetting the 25% year-on-year decline in global demand for project finance loans.

M&A and ECM activity continues to be affected by high macroeconomic and geopolitical uncertainty, resulting in declines in activity levels in our core geographies.

The cross-border business at BBVA CIB

BBVA's extensive reach and the experience of its global teams allow BBVA CIB to offer cross-border solutions to clients wherever they need them, resulting in more than 26% growth in this business. So far in 2024, there has been a notable growth in IB&F business, with an increase of 40%, especially in financing activity between South America and the United States. GM's business growth in the Latin American region is also noteworthy.

In line with global trade flows, the regions of Spain, Mexico and Europe continue to be the most relevant for European, American and Asian customers, the latter with increasing relevance.

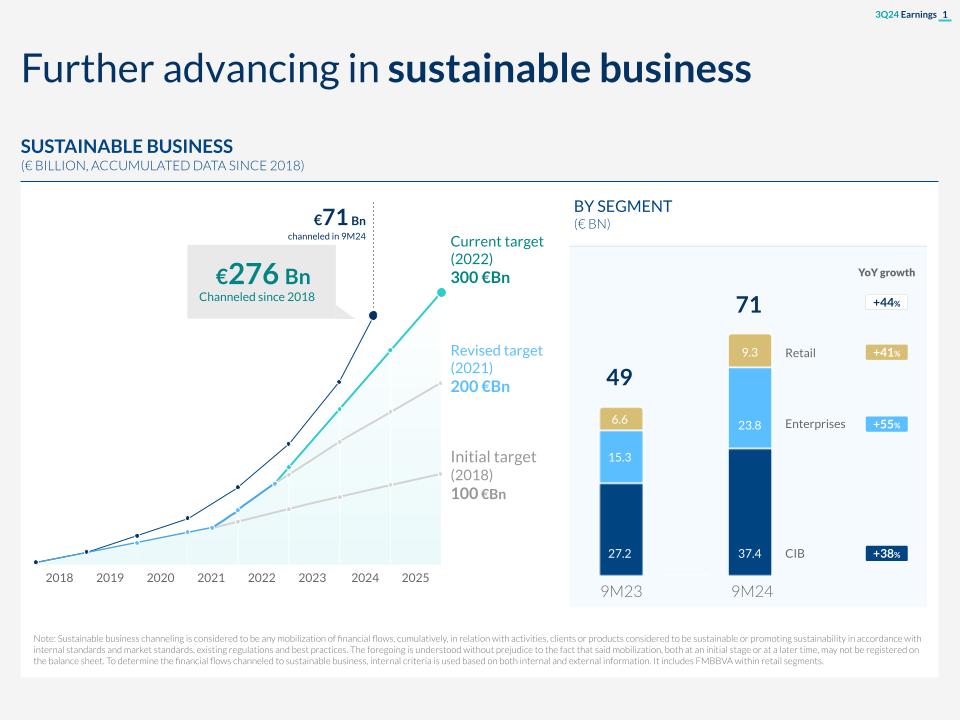

Sustainability as a driver of business

BBVA CIB channeled approximately €37 billion of sustainable financing between January and September 2024, an increase of 38% compared to the same period last year. Around €13 billion was mobilized during the quarter. BBVA has continued to promote the financing of clean technologies and renewable energy projects in the wholesale segment, as well as sustainable supply chain finance, among other strategic lines. In terms of channeling in the third quarter of 2024, the financing of renewable energy projects stands out, contributing around 690 million euros during the quarter, which is more than double compared to the same period of the previous year, with the contribution of the United States being fundamental, channeling more than half in this section.

Additionally, during this quarter, the opening of a new office in Houston was announced with the aim of leading the financing of the energy transition in the United States. This sustainability drive is part of BBVA Group's growth plans in the country and is integrated into its CIB operations. BBVA's new Houston office joins cleantech innovation finance teams in New York, London and Madrid.

Industry recognition for BBVA CIB

In this quarter, BBVA CIB received important awards that reaffirm its leadership and its ability to offer value-added solutions to its wholesale clients. At the Euromoney Awards for Excellence 2024, BBVA was recognized as Latin America Best Bank for Transaction Services, Mexico Best Investment Bank, and Best Bank for Corporates in Spain, Mexico and Peru. In addition, at the Euromoney Foreign Exchange Awards 2024, BBVA was awarded as the best FX bank in Colombia and Peru, thus highlighting its strength in the foreign exchange market in Latin America.

The Global Markets team has also been recognized for its capabilities and services through several awards granted by Structured Retail Products for the Americas region: best digital platform, best distributor in Mexico, and Best Performance, Mexico.

In addition, BBVA was recognized for its participation in several infrastructure and project finance operations in Latin America, in the LatinFinance Project & Infrastructure Deals of the Year 2024.

These recognitions underscore BBVA CIB's commitment to excellence and its ability to adapt to the needs of its customers in the different markets in which it operates.