31 October 2023

BBVA CIB achieves revenues of 3.743 billion euros in the first nine months of the year

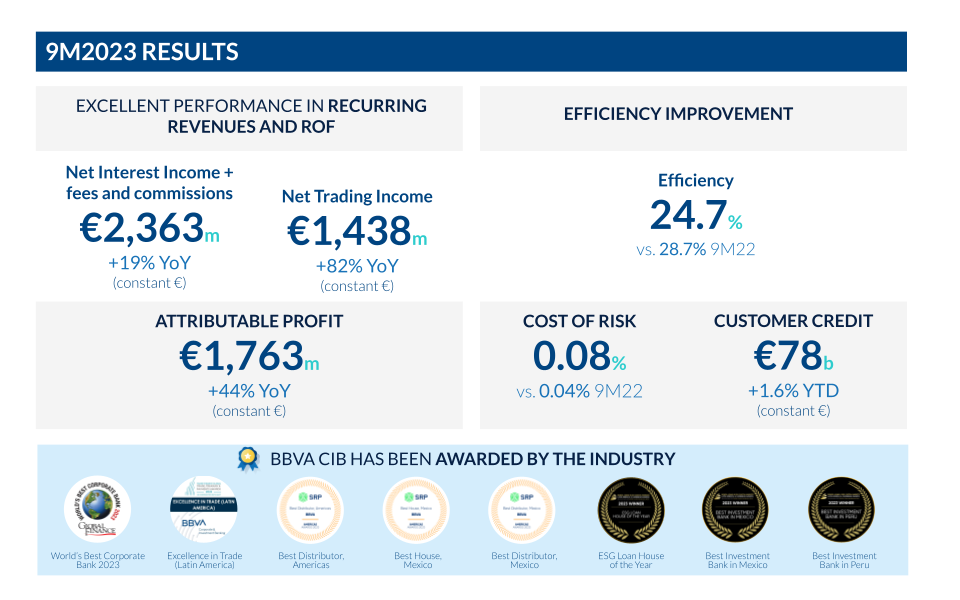

- BBVA CIB achieves accumulated net attributable profit of 1.763 billion euros in the year to September 2023, year-on-year growth of 44% (in constant euros and not reflecting the application of hyperinflation accounting).

- The highlight of the quarter is the growth in revenues, which reached 1.253 billion euros in the period between July and September, 39% more than in the same period of 2022.

- Growth in all business units, especially in Global Markets, mainly in the United States and Emerging Markets, the contribution of Global Transaction Banking in all geographies, and Project Finance in Investment Banking & Finance.

- Improvement in the efficiency ratio, which stands at 24.7%, and increase in the profitability of the businesses.

BBVA CIB's results during the third quarter of the year reflect the excellent performance of its strategy, leveraging a global approach and sustainability. This is reflected in the outstanding results of all the business units and in their geographical diversification. Current uncertainty and high interest rates are affecting demand for credit worldwide, which is continuing to show declining volumes of activity compared to the already relatively weak volumes in 2022. However, the global macro context is better than expected a year ago, and some dynamics are making the outlook for BBVA CIB's business positive.

Business units performance

The Global Markets business performed well, with a strong contribution from the Credit and Foreign Exchange (FX) businesses. The Credit business delivered excellent results in the primary market in both the United States and Europe, where BBVA CIB has been involved in more transactions and has added new clients. The performance of BBVA's FX business in its core markets was outstanding, driven by cross-border transactions and increased volatility in some currencies.

Global Transaction Banking (GTB) continued its positive trend from the first half of the year in the third quarter, again outstripping the record revenues achieved in previous quarters. Consolidation of interest rate increases was one of the main drivers of revenue growth, with a very positive performance in net interest income in the quarter. The performance and growth of transactional activity with customers was again strong, with double-digit growth in fees and commissions. The guarantees business also performed well, recording all-time highs in the third quarter.

Investment Banking & Finance (IB&F) consolidated its strong earnings performance in most markets. This was due to its capacity to lead the largest syndicated loan and acquisition financing operations in BBVA's core geographies, and to the excellent performance of the Project Finance business, which is also developing the new USA Clean Tech and Renewables segments. Corporate finance markets are continuing to face macroeconomic uncertainties and volatility, with the downward trend in M&A activity continuing in most geographies. However, the Equity Capital Markets (ECM) business has shown incipient signs of recovery in most geographies. Despite the general fall in syndicated financing and advisory services, BBVA has retained leading positions in the Corporate Lending and Project Finance league tables in its main geographies.

A geographically diversified business

BBVA CIB is a global investment bank with local presence and experience. Its differential value lies in its widely diverse products and countries, combined with its proximity to and knowledge of its clients and the geographies in which it operates. This gives this business area a cross-cutting vision of its clients and their entire value chain.

The geographic diversification of CIB's revenues continues to be one of the main pillars of creating value for the Group. CIB's contribution to cumulative net attributable profit at the end of September 2023 was as follows: Spain 16%, Mexico 26%, Turkey 29%, South America 13%, and Other Businesses (Asia, USA, and Europe excluding Spain) 16%.

Growth in the cross-border business was also significant, standing at over 30% at the end of the quarter. This reflects BBVA CIB's capacity to exploit its geographical diversification to capture business with wholesale and institutional customers outside their countries of origin. The outlook is also very positive. BBVA CIB is continuing to focus on increasing cross-border revenues by leveraging existing opportunities deriving from nearshoring (Mexico, the USA and Asia), as well as initiatives to increase its customer base in key geographies, such as the United States.

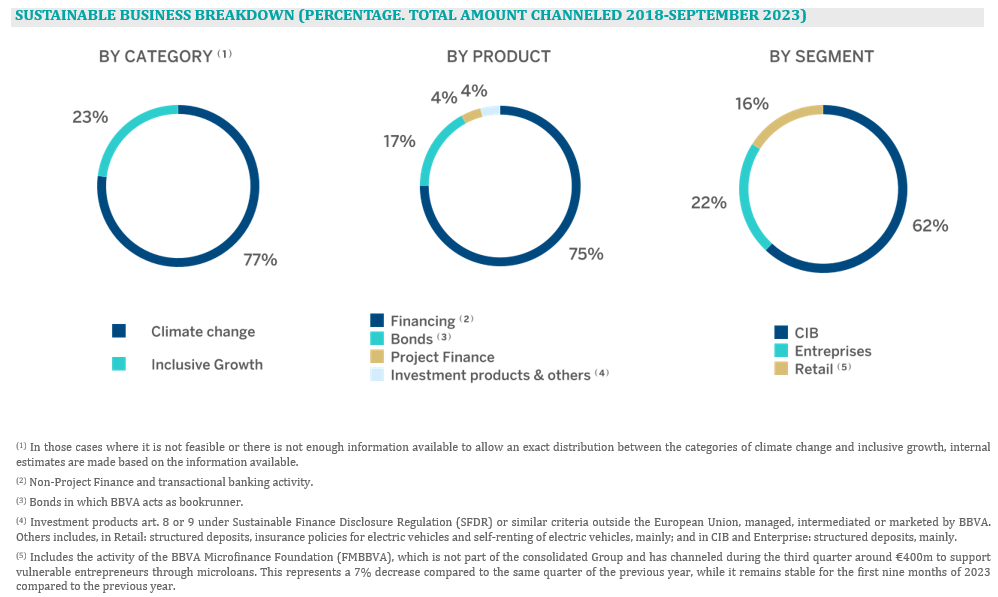

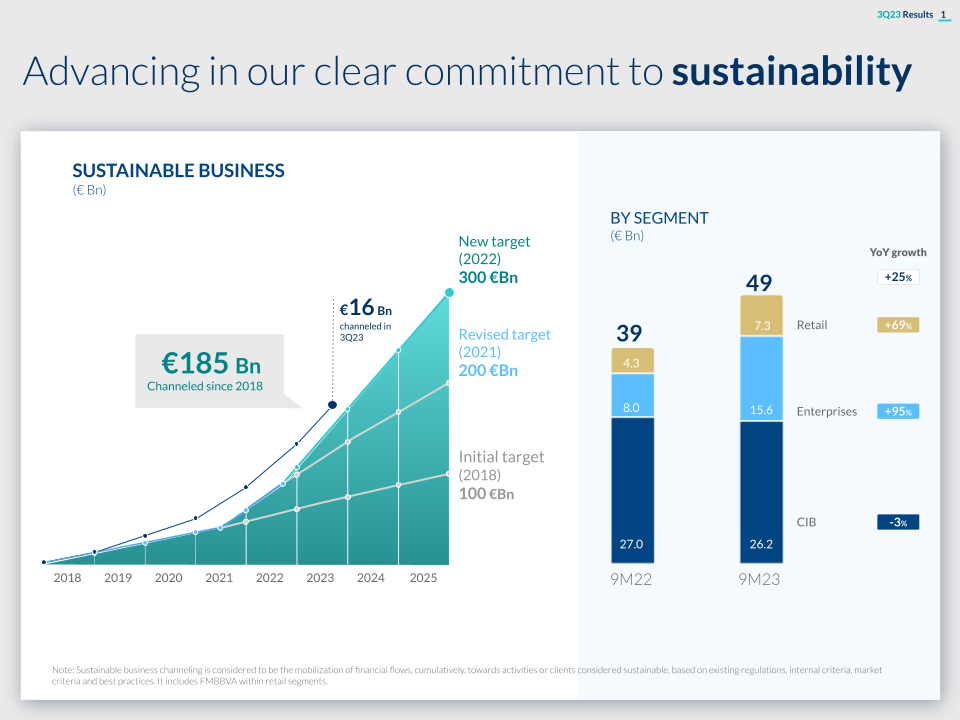

Sustainability as a driver of business

BBVA CIB channeled around 8.1 billion euros in sustainable financing in the third quarter and approximately 26.2 billion euros in the first 9 months of the year. The positive performance of sustainable short-term financing and transactional banking activity during the quarter stands out, contributing some 4.4 billion euros, over half of the funds channeled by the corporate segment in the quarter. This represents a 34% year-on-year increase, and a 10% increase in the accumulated volume since January 2023 compared to the accumulated amount in the same period during the previous year. While some signs of a slowdown in sustainable corporate financing have been noted since the start of 2023, particularly in long-term financing, there has also been increased activity in the sustainable bond market, where BBVA acts as a bookrunner.

Industry recognition for BBVA CIB

BBVA has received industry recognition from Global Finance as the best bank for corporate clients in the world. This is the third time that BBVA's banking services and corporate customer relationship model have won Global Finance's highest recognition, after winning in 2019 and 2021. The services the bank provides give companies solutions that help them increase sales, reduce costs, manage financial risks, and strengthen relationships with their stakeholders (customers, suppliers and employees).

At the regional level, recognition was also received from the trade media 'Bonds & Loans', which named BBVA the ESG Loan House of the year and best investment bank in Mexico and Peru in its Latin American and Caribbean awards. Trade Finance Global also recognized BBVA's capabilities in Latin America by awarding the bank its 'Excellence in Trade' distinction for this region in its 2023 Trade, Treasury and Payments Awards.