News | 09 May 2023

BBVA CIB boosts global growth with magnificent first quarter results

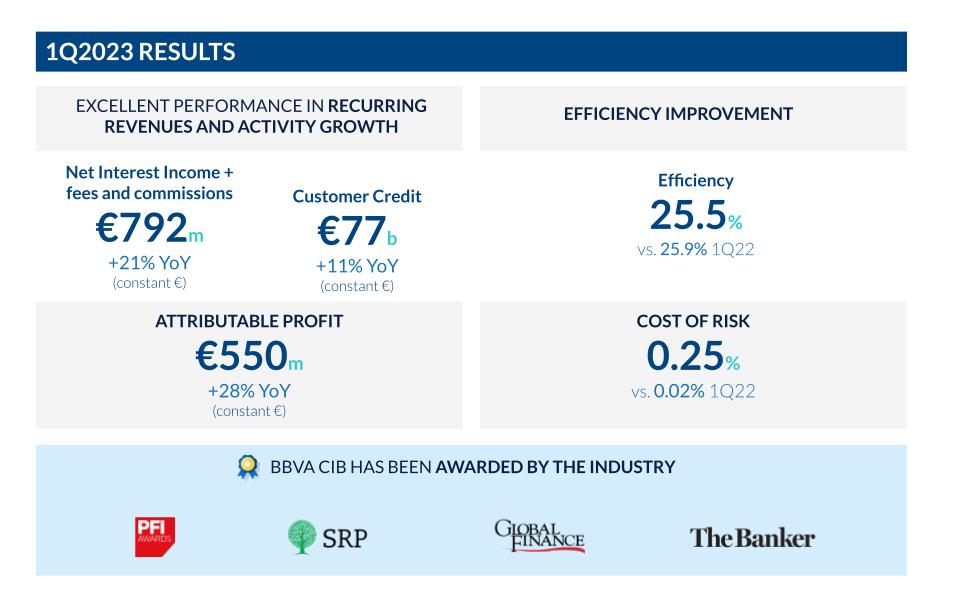

- CIB generated an attributable profit of EUR 550 million in the first quarter of 2023. These results represent a +28.1% year-on-year comparison (in constant euros and excluding the application of accounting for hyperinflation).

- The excellent quarter is marked by the evolution of revenues, with a result of EUR 1,195 million, +24% compared to Q1 2022. Growth in all business areas; the contribution of Global Transactional Banking in all geographies of particular note.

- Improvement of the cost-to-income, which stands at 25.5%, and increase in business profitability.

BBVA CIB's results in the first quarter of the year reflect the contribution of the diversification of products and geographies and the area's progress in developing its strategy, leveraged on globality and sustainability, with the aim of being relevant for its clients. All divisions achieved good results in the heat of some favourable market dynamics and a more robust macroeconomic context than expected. However, the evolution of activity has been slower than expected, due to a context of low visibility for companies given the current environment of interest rates and the expected economic slowdown.

Despite this context of uncertainty, Global Markets' revenues grew thanks to the excellent performance of the Fixed Income Currencies and Commodities (FICC) business. Of note were Foreign Exchange (FX) and Credit with good activity with clients and a recovered primary activity as well as good structured credit activity.

Of note in primary market issues was the reactivation of the sustainable bond market, compared with a 2022 market penalised by the rise in interest rates. Of particular significance in BBVA CIB's activity in this market was the notable 87% increase in the brokerage volumes of sustainable bonds in which BBVA CIB acted as bookrunner. This increase in brokerage volume was largely driven by greater dynamism in green bonds, a segment that stands out with an increase of 103% compared to the same quarter of 2022.

Despite the aforementioned slowdown in demand for credit from large companies, Investment Banking & Finance achieved a good performance in revenues, largely due to the excellent evolution of Project Finance business in the US and in the energy sector. Geographically, Türkiye, the USA and Mexico stand out, thanks to greater dynamism in these markets, and the latter in particular stands out in all financing activity. The syndicated and corporate finance markets have been affected by macroeconomic and geopolitical uncertainty and volatility, which has resulted in a generalized scenario of falling activity across geographies. Despite this, BBVA maintained its leadership positions in the Corporate Lending and Project Finance league tables in its main geographical areas.

The Global Transaction Banking business posted a record quarter in revenue generation. Widespread interest rate hikes have boosted the unit's Net Interest Income performance compared to the same period last year, despite a somewhat subdued financing activity. There has also been significant transactional activity with customers, which has led to a significant generation of fee and commission revenues.

Global growth driven by business lines

The geographic diversification of CIB's revenues continues to be one of the main pillars of the value contribution to the Group. At the end of March 2023, the contribution to CIB's accumulated net attributable profit was as follows: 19% Spain, 26% Mexico, 25% Türkiye, 16% South America and 15% Rest of Businesses (Asia, USA, rest of Europe).

Europe has contributed with good levels of activity and Spain has stood out for its strong performance in transactional banking. Mexico continues to benefit from the current positive trend in nearshoring, and the USA has strengthened its contribution to CIB with relevant results in some of the core products for the geography, such as Project Finance.