29 April 2025

BBVA CIB posts record revenues of €1.71 billion in Q1 2025

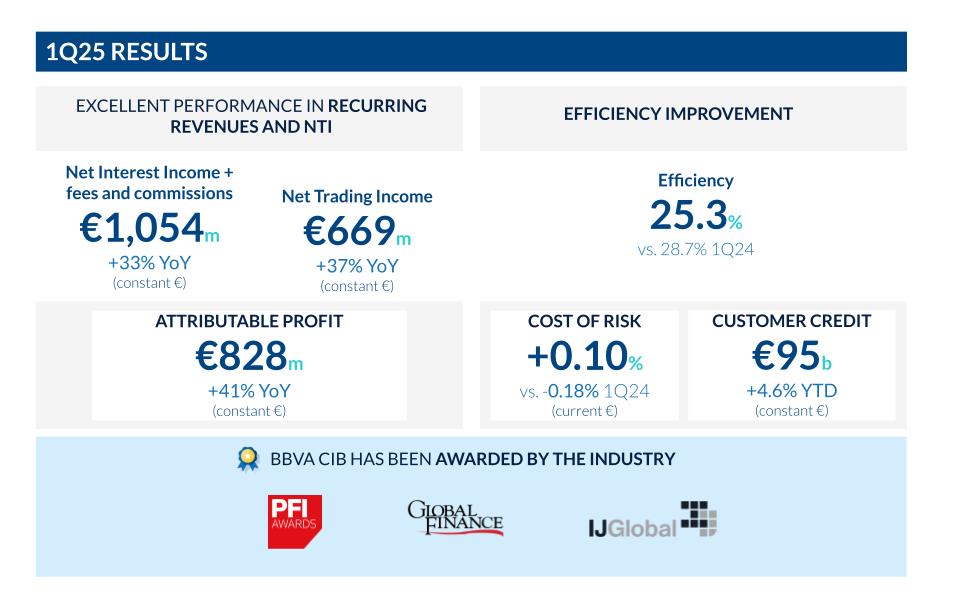

CIB’s revenues reached €1.71 billion, up 36 percent year on year (in constant euros, excluding the hyperinflationary accounting adjustment). All business units grew at double-digit rates: Global Markets (GM) 52 percent YoY; Global Transaction Banking (GTB) 19 percent YoY; and Investment Banking & Finance (IB&F) 33 percent YoY. BBVA CIB also reported 4.6 percent growth in lending compared to December 2024, at both the transactional business and IB&F. Spain, Mexico and the U.S. headed up this growth by completing some outstanding transactions in project finance and corporate lending. Attributable profit at BBVA CIB came to €828 million, up 41 percent year on year. Business profitability increased in the first quarter, especially in Spain, continental Europe and the U.S.

BBVA Corporate & Investment Banking reported revenue of €1.71 billion in the first quarter of 2025, up 36 percent on the same period in 2024. BBVA's investment banking division excelled by achieving an attributable profit of €828 million, marking a 41 percent increase compared to the same period of 2024.

Client activity continues to grow, driven by sector-specific expertise

In 2025, BBVA CIB has continued to strengthen its relationships with institutional and corporate clients worldwide through its sector-specialized model. Notably, the bank has expanded its presence in key regions such as the U.S., the U.K, Europe, Asia, and Brazil, cementing its position as a strategic partner.

The advisory model is built around 10 core sectors, focused on maximizing opportunities linked to the energy transition, especially in high-emission industries. In this context, revenue from corporate clients rose 13 percent year on year in the first quarter, with particularly impressive growth in: consumer & retail: up 26 percent YoY; industry & transport: up 12 percent YoY; and energy: up 18 percent YoY.

The institutional client business also got off to a strong start in 2025, growing 18 percent YoY. Standout sectors here include banking (up 22 percent YoY); and the public sector (up 34 percent YoY).

Performance by business unit

Global Markets (GM) began 2025 with strong performance. Volatility from geopolitical factors has incentivized client hedging and made it possible to take advantage of opportunities in the markets. The equity business has had a record-breaking start to the year, backed by both strong momentum in internal networks and by active risk management, making it possible to capitalize on market movements. In ‘G10 rates’, interest rate normalization has continued to boost activity, confirming the positive trend observed in 2024, while activity in ‘EM rates’ in Mexico produced strong results.

In the credit business, higher activity in the U.S. stood out, with double-digit performance in a flat market. Good dynamics were also observed in Mexico, both in the primary and secondary market. These results are a reflection of a global, diversified, customer-oriented franchise.

Meanwhile, Global Transaction Banking (GTB) started 2025 with a strong first quarter, reaching €611 million in income, a 19 percent increase over the same period last year. Forward momentum in the business is continuing despite a context of macroeconomic and political instability, buoyed by resilient lending volumes, deposits and guarantees, which remain at historic levels following the peaks reached in 2024. These results demonstrate the progress made toward the strategic pillars defined by the unit to boost its development, such as the launch of new product capabilities (including receivables finance and securitization solutions), expansion into key markets like Mexico, the U.K., Brazil and the U.S., and the consolidation of its sectoral specialization model, which continues to improve both commercial efficiency and allow the bank to further customize the products and services it offers. In parallel, income quality remains strong, with recurring commissions and fees growing at double-digit rates in the quarter, driven by significant transactions with clients in Spain and Mexico, as well as solid performance in transactional banking and foreign trade. Moreover, the cost-to-income ratios remain well below industry standards, once again confirming GTB’s excellent efficiency in early 2025.

Investment Banking & Finance (IB&F) also achieved excellent Q1 results, having amassed €325 million in revenue, up 33 percent over the same period last year. This growth mainly occurred in the U.S., Europe, Asia and Colombia, despite the unstable economic environment and a global contraction in syndicated loan demand, which has fallen 12 percent—the lowest level in the past two years.

Although the global political and macroeconomic environment is affecting corporate finance activity, the strength of BBVA's business model has allowed it to make further progress in the main markets in which it operates, achieving double-digit growth in the first quarter of 2025.

Cross-border business at BBVA CIB

The cross-border business, bolstered by the Group’s competitive advantage from its geographic footprint, maintained strong momentum, growing nearly 15 percent over recent quarters. This growth was especially significant in both the U.S. and Europe, driven by closer relationships with institutional clients, as BBVA supported them with their business and expansion, especially through structured finance products.

Mexico, Europe and Spain remain the most dynamic regions, accounting for the bulk of activity and growth, especially in operations with clients from the Americas, Europe and Asia.

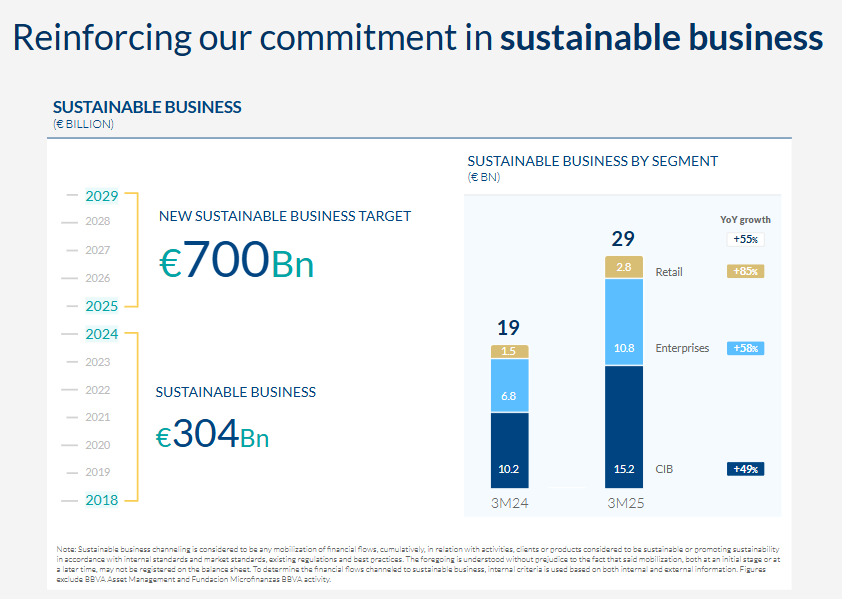

Sustainability as a business lever

Between January and March 2025, BBVA CIB channelled around €15.2 billion into the sustainable business, mainly through corporate lending, factoring, guarantees, and bond origination. This represents a 49 percent increase year on year. BBVA continues to support cleantech and renewable energy financing, along with sustainability-linked reverse factoring and other strategic initiatives. Notably, renewable energy projects contributed around €600 million in Q1 alone.

Industry recognition for BBVA CIB

In this first quarter of 2025, the industry has notably recognized BBVA CIB’s efforts to maintain its high standards of service quality and its ability to adapt to the diverse needs of its clients across the different markets in which it operates. In this way, the North American publication Global Finance awarded BBVA CIB in the 'Best Investment Banks Awards 2025' in the categories of Best Investment Bank in Colombia, Mexico, and Spain; Best Sustainable Finance Bank in Spain; and Best Debt Bank in Latin America.

On the other hand, both the specialized magazine IJ Global and PFI have recognized several of the operations formalized by BBVA CIB in Latin America, the United States and Europe.