30 January 2025

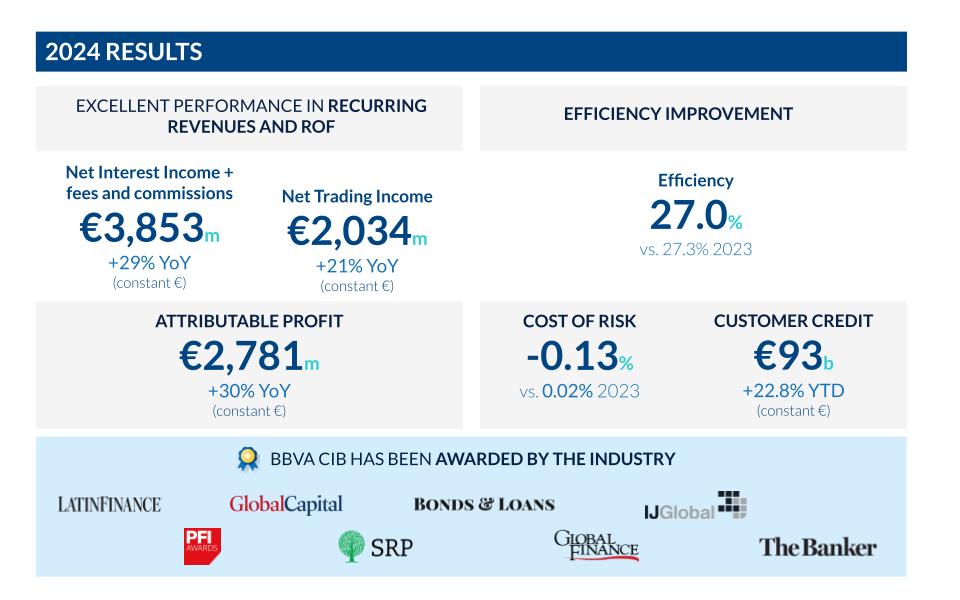

BBVA CIB reaches a record revenue of €5,832 million in 2024

- Growth in lending activity, both in the transactional business and in IB&F. The United Kingdom, Europe and the United States drive this growth, with major deals mainly in Project Finance and Corporate Lending.

- CIB's revenues reached €5,832 million, 27% up from the same period in 2023 (in constant euros and do not include the application of the hyperinflation adjustment in the accounting records).

- All business units grew by double digits: Global Markets +21% YoY, supported by the excellent performance of the Equities, Rates and Credit segments; Global Transaction Banking +32% YoY, thanks to the positive progress of recurring revenues, mainly net interest income; Investment Banking & Finance +31% YoY, excellent activity in Project Finance and Corporate Lending, benefiting both net interest income and fees and commissions.

- As for net attributable profit, BBVA CIB achieved a profit of 2,781 million euros, with a year-on-year increase of +30%.

- In 2024, profitability increased, especially in Spain, the United Kingdom and the United States.

BBVA Corporate & Investment Banking achieved revenues of €5,832 million in 2024, an increase of 27% compared to the previous year. Also, BBVA's investment banking division stood out for obtaining a net attributable profit of €2,781 million, +30% YoY. With these figures, BBVA CIB contributes 16% to the Group's gross income, reinforcing its strategic positioning as an important pillar of growth for the coming years.

Client activity has grown supported by sectoral specialization

Supported by its sectoral specialization model that centers around the sustainability of production models, in 2024, BBVA CIB has focused on strengthening its relationship with institutional and corporate clients at a global level. To this end, CIB has been strengthened in key regions such as the United States, the United Kingdom, Europe and Brazil.

BBVA CIB's sector advisory model is structured around seven key sectors to maximize the opportunities of the energy transition, with a special focus on those that generate the highest emissions. 2024 saw a very positive global performance of the corporate client segment with a growth of 15%.

The key levers for this performance have been sustainability, where BBVA is positioned as a key partner to help its clients in their energy transition; elevate strategic dialogue with our clients, and identify opportunities across industries and geographies. By industries, Consumer Goods, Retail and Health and Industry and Transport are of particular notice, with a growth of 16% and 18% respectively, the sectors with the highest relative weight; Energy, with 13%; Infrastructure and Construction, with 12%; and, finally, Technology, Media and Communications (TMT), growing at 14%.

For its part, the institutional client business has recorded a solid performance, up by 36%. This progress has been achieved thanks to a diversified and balanced revenue mix across sectors, products and geographies, all with growth of more than 20%. In particular, the contribution of the Financial Sponsors sector, with an increase of 63%, driven by the activity of structured finance and capital calls in the United States and the United Kingdom, geographies in which this sector has grown by 80% and 42%, respectively. Investment Banking & Finance activity for this type of client has also contributed significantly.

Business unit performance

Global Markets (GM) has had outstanding results in 2024, reaching €2,102 million in revenue and growing at double digits (approximately 21%). Of note is the excellent performance of the Equities segments, which grew by 40%, driven by the expansion of the structured products business together with a solid performance in financing activities. The same has happened at G10 Rates, supported by structured products and corporate business in the Americas.

The Credit business has performed positively, with a significant increase in the volume of bond issues in developed and emerging markets, namely BBVA's participation as the only European bank in the issue of 10-year bonds of the Turkish Treasury. In addition, there has been strong growth in the value-added solutions and services business, both in structured products and in financing ("Securities Finance").

Global Transaction Banking (GTB) closed a record last quarter of the year, with revenues of €694 million, reaching an annual figure of €2,460 million, 32% more than in 2023. These results are achieved against a challenging context of interest rate cuts in Europe and the U.S., where the transactional business has shown remarkable resilience and solid performance. The historic growth is explained by the intense activity in volumes of loans, customer funds and guarantees, which set record highs in the last quarter of the year. In addition, foreign trade and institutional business played a key role in achieving these results. Revenue quality was reinforced by double-digit growth in recurring fees and commissions, both in the quarter and for the year to date. Finally, advances in efficiency consolidated GTB's excellent performance in 2024.

Investment Banking & Finance (IB&F) closed 2024 with record-breaking revenues of €1,206 million, +31% YoY. This result is due to the excellent performance of activity in the United States, the rest of Europe and Spain. Syndicated loans have played a leading role, consolidating their recovery and reaching 2021 levels in terms of volume. In addition, there has been notable progress in corporate lending and project finance, areas in which BBVA continues to lead in its main geographies.

In particular, Project Finance has achieved an outstanding result, mainly in renewable energies, and it has grown significantly in geographies such as the United States, Europe and Latin America. Also very relevant are the results in Cleantech, the initiative launched 1.5 years ago with specific teams to position themselves in these new technologies, and which already represents 15% of Project Finance's activity.

M&A and ECM activity continues to be affected by high macroeconomic and geopolitical uncertainty, resulting in declines in activity levels in our core geographies.

The cross-border business at BBVA CIB

BBVA's extensive presence and the experience of its teams on a global scale allow the institution to offer cross-border solutions to clients wherever they need them, which has led to a growth of more than 20% in this business.

In 2024, the greater demand for derivatives products in Global Markets (+30%), as well as structured finance (+35%) was notable. Mexico, Europe and Spain continue to be the regions with the highest activity and growth, especially with American, European and Asian clients.

Sustainability as a driver of business

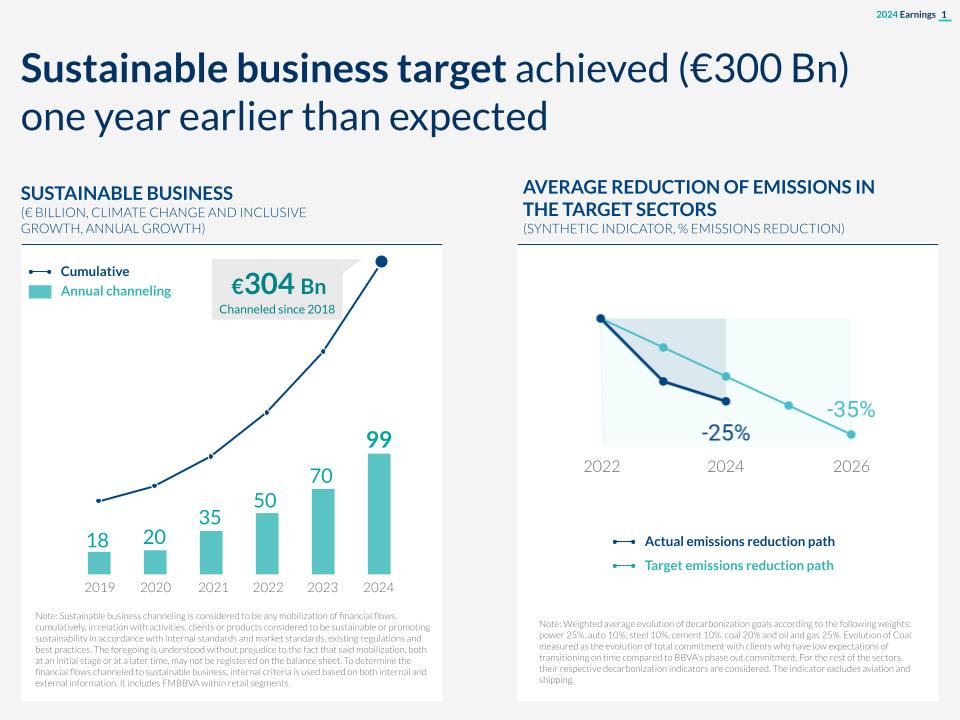

CIB channeled approximately €51,100 million of sustainable financing between January and December 2024, an increase of 27% compared to the same period last year. During the last quarter of the year, approximately €14,600 million have been mobilized.

BBVA has continued to promote the funding of clean technologies and renewable energy projects in the wholesale segment, as well as accounts payable financing linked to sustainability, among other strategic lines. In terms of channeling in 2024, we must mention the financing of renewable energy projects, which contributed around 900 million euros during the quarter, up more than double YoY. The United States played a key role, channeling more than half in this heading.

Industry recognition for BBVA CIB

In this quarter, BBVA CIB has reaffirmed its commitment to excellence and its ability to adapt to the needs of its clients in the different markets where it operates, collaborating in transactions that have been widely recognized by the industry. In the Latin Finance Deals of the Year Awards 2024, several transactions in which BBVA participated were recognized: Structured Financing of the Year, for the project with FIEMEX; Domestic M&A Deal of the Year, for the investment of Mexico Iberdrola; Loan of the Year, for the transaction with Pemex & PMI; and Corporate Liability Management of the Year, for the debt restructuring of Telecom Argentina.

Also, the trade magazine Global Banking & Markets has recognized BBVA CIB's capabilities and services in the Americas region with several awards, including "Best Investment Bank" in Mexico and Colombia, as well as the awards for "Best Loan House of the Year", "Best M&A Loan House of the Year" and "Most Innovative Loan House of the Year".

The Global Markets team has also reaffirmed its global leadership in the Foreign Exchange business by receiving Global Finance's awards for best FX bank in Spain, Colombia and Turkey, and by receiving recognitions for the best FX technology solution for small and medium-sized businesses.

The Global Transaction Banking team was also selected by Global Finance as the best Trade Finance Provider in Peru, Spain and Uruguay, consolidating its position as a leading player in international trade solutions in these markets.