31 July 2024

BBVA CIB reaches record revenues of 2,872 million euros in the first half of 2024

- Growth in lending activity, thanks to the favorable performance of both Project Finance and the transactional business.

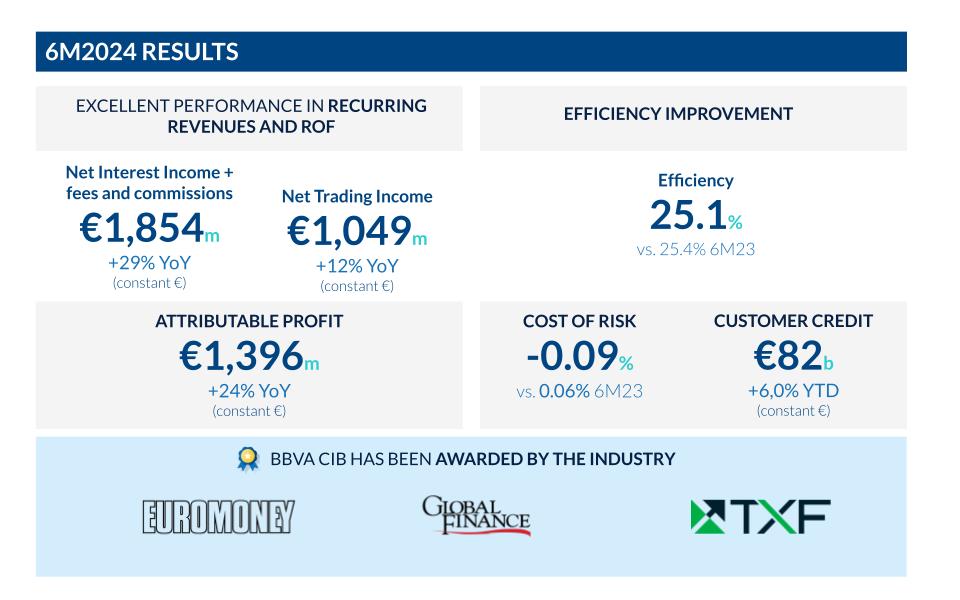

- CIB revenues reached 2,872 million euros, 23% up from 2023 (in constant euros and does not include the accounting application of the adjustment for hyperinflation).

- All business units growing at double digit: Global Markets +11% YoY, supported by good commercial activity, particularly Credit in Europe as well as Equity in the USA and Mexico; GTB +37% YoY, thanks to the positive performance of recurring revenues; and IB&F +22% YoY, with excellent activity in Project Finance in the Americas and Europe, with a positive impact on net interest income and revenue from fees and commissions.

- As for net attributable profit, BBVA CIB achieved a profit of 1,396 million euros, with a year-on-year increase of +24%.

- Improvement in the efficiency ratio, which stands at 25.1%, and increase in the profitability of the businesses.

In the first half of 2024, BBVA Corporate & Investment Banking generated revenues of 2,872 million euros, up by 23% on 2023. The company's investment banking division stood out for achieving a net attributable profit of 1,396 million euros, +24% YoY.

As at the end of June 2024, BBVA CIB maintained its contribution of 15% to the Group's gross income, to which all business units contribute. The entity devises its strategy based on globality, with a focus on geographical diversification, the opportunities derived from nearshoring and the increased relevance of business with institutional clients; and sustainability, which will be the cornerstone of the value proposition for wholesale banking globally.

Business units performance

Global Markets has ended the first half of 2024 with a slight growth compared to 2023. Excluding the effect of the excellent first half of 2023 in Turkey, the results of the Global Markets unit show double-digit growth driven by strong commercial activity. In terms of product, we should mention the contribution of Equity, supported by the development of its product platform, and Credit, both in primary and secondary markets. Low volatility presents a challenge in the Foreign Exchange (FX) business, which has managed to close the first half of the year with a slight growth thanks to BBVA's leadership in emerging currencies.

Global Transaction Banking closed the first half of 2024 with revenues of 1,195 million euros, +37% compared to 2023. This reflects extraordinary revenue generation supported by solid activity data, with a strong dynamism of trade finance and institutional clients; and last but not least, the outstanding price management. The second quarter of 2024 closed with a record revenue of 627 million euros, above the 568 million euros in the first quarter of 2024, and with a fees heading generating recurrence in the income statement, which again closed the first half of the year with double-digit growth.

The Investment Banking & Finance activity consolidated its excellent performance in the first half of the year, with revenues of 568 million euros (+22% YoY), mainly in Spain, USA and the rest of Europe. Of note is the magnificent performance of the Project Finance business, where BBVA remains number one by volume in Mexico, Colombia and Peru, against a climate of contraction in global demand for loans for project financing (-11%) YoY.

M&A activity continues to be affected by macroeconomic and geopolitical uncertainties, resulting in lower activity in our core geographies, while Equity Capital Markets showed a slight uptick in activity in most geographies, due to the resurgence of the IPO market.

A geographically diversified business

BBVA CIB is strengthening its teams in the relevant wholesale markets where the Bank does not have a retail customer branch network. The goal is to increase the current weight of developed markets and countries with strong currencies, such as the United States and the United Kingdom, and also to increase the presence in regions or countries such as Asia, Brazil and Chile, to continue promoting the cross-border business that continues to consolidate as a strategic pillar thanks to its contribution to the wholesale business.

Thanks to BBVA CIB's positioning and its product capabilities in various geographies, the cross-border business is on a growth path of more than 26% in 2024, compared to the growth of more than 30% experienced in 2023. Following the flows of global trade, activity continues to be highly focused on transactions of large clients in Europe (particularly Spain), the United States and Asia, Latin America and Mexico (a particular beneficiary of nearshoring).

BBVA CIB is also expanding its capabilities in markets such as Turkey, where it has played a particularly important role in the bond market in line with the dynamism of this market. In addition, there was recovery in Latin America's lending activity in U.S. dollars, where BBVA is being very active. Finally, the United States and Europe continue to be very important markets locally to capture sustainable opportunities with current and new clients.

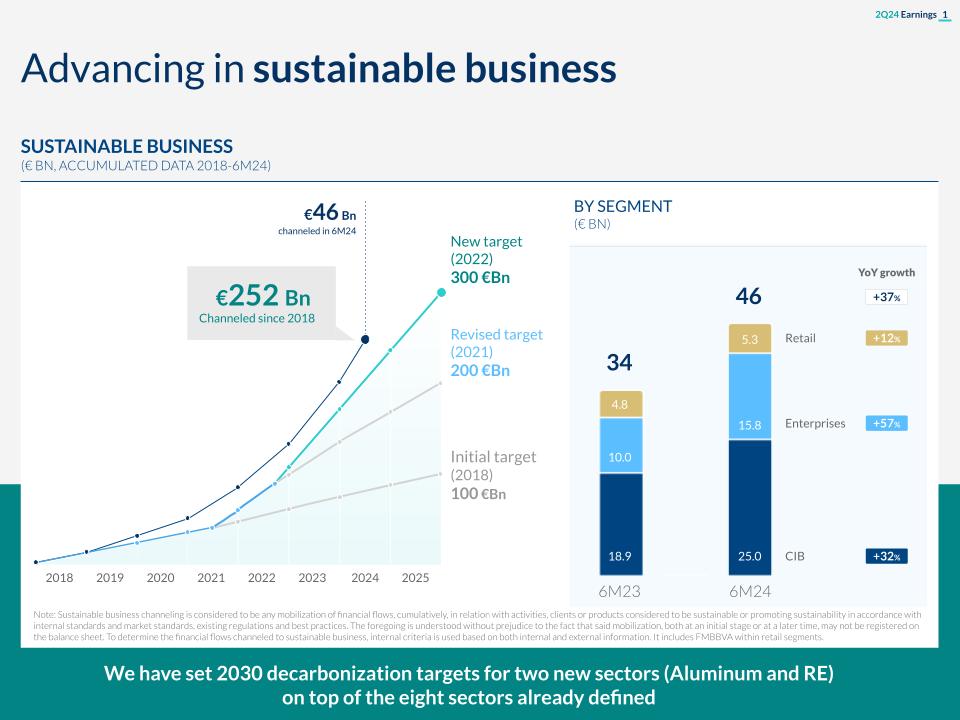

Sustainability as a driver of business

CIB has channeled around 25 billion euros during the first half of 2024, which represents a growth of 32% YoY. During the second quarter, around 14 billion euros were mobilized.

BBVA has continued to promote the financing of clean technologies and renewable energy projects in the wholesale segment, as well as sustainability-linked supply chain finance, among other strategic lines. As regards channeling in the second quarter of 2024, renewable energy project finance stands out, contributing around 400 million euros, more than doubling the figure YoY.

Industry recognition for BBVA CIB

The industry has continued to recognize the capabilities offered by BBVA CIB to its wholesale customers. The differential value proposition for the management of working capital (cash management) has earned the bank the recognition of Global Finance as the best cash management bank in Colombia, Mexico, Peru, Venezuela and Turkey. Also, the magazine has once again elected BBVA as the best sub-custodian bank in Spain, a recognition awarded to the Global Securities Services since 2012, without interruptions.

BBVA CIB has also received six awards at the Euromoney Awards for Excellence 2024: Best bank for transactional services in Latin America; best investment bank in Mexico; and best bank for corporate clients in Mexico, Colombia, Peru and Spain. These prestigious recognitions underscore BBVA's commitment to offering excellent service to its wholesale customers and its ability to structure and offer the best solutions in the various markets in which it operates.