20 November 2024

What is supply chain finance and what is it for?

In an increasingly interconnected world, companies are continually looking for new ways to improve efficiency and better manage their resources. One of the most effective approaches to achieving this is Supply Chain Finance (SCF), a financial solution designed to optimize buyer-supplier relationships and free up working capital trapped in the supply chain.

What is Supply Chain Finance?

Supply Chain Finance (SCF) is a financial solution that supports the different suppliers and business partners within a production chain. Its main objective is to improve companies' liquidity, by releasing working capital that would otherwise be retained in the supply chain.

What is Supply Chain Finance used for and what is its importance?

From a strategic perspective, Supply Chain Finance not only facilitates the relationship between purchasing companies and suppliers, but also strengthens cash flow and contributes to more efficient capital management. Over the past two decades, this solution consolidated its position as a key pillar for companies looking to optimize their financial and operational activities.

The impact of digitalization on Supply Chain Finance

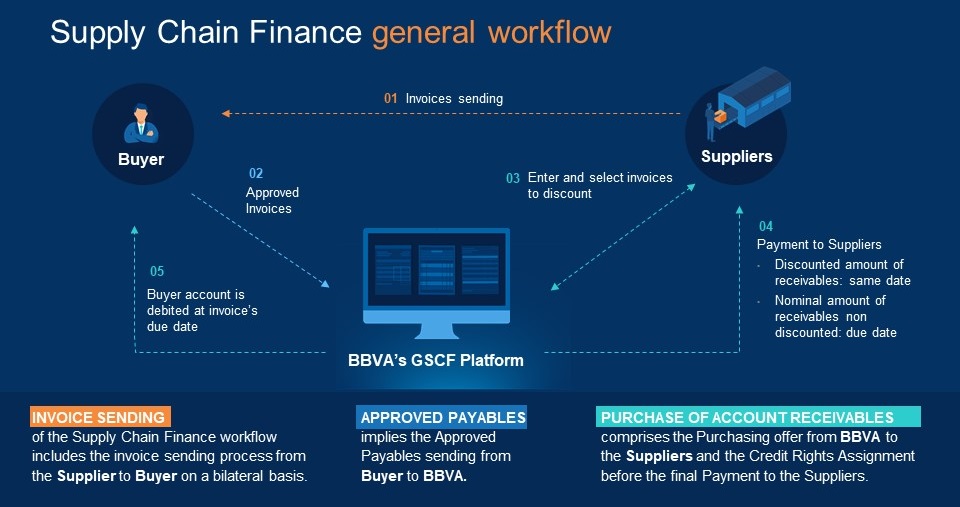

As the Supply Chain Finance has evolved, digitalization has played a crucial role in its adoption and expansion. Today, digital solutions have simplified many of the traditional processes, allowing businesses to manage their financial operations faster and more efficiently.

One of the most significant advancements is the automation of tasks such as issuing and processing invoices, managing payments, and reconciling accounts. By digitizing these processes, companies can reduce human error, save time, and improve transparency throughout the supply chain.

In addition, digitalization facilitates the availability of detailed and accurate information, which is essential not only for the internal reconciliation of companies, but also to comply with new regulatory requirements. With recent changes in accounting regulations, buyers are required to itemize in their annual accounts the information on payments made through SCF. This level of transparency is vital to comply with regulations and to ensure clear and efficient management of financial flows. Thanks to digitalization, it is possible to access this data more easily and quickly, thus improving control and accountability.

Additionally, digital platforms provide unprecedented visibility throughout the entire supply chain. Companies can track products from the point of origin to the point of consumption, allowing them to identify bottlenecks, manage risks, and make more informed decisions in real time.

Sustainability as a driver of its growth

In addition to the financial and operational benefits, SCF is proving to be a key tool to drive sustainability in supply chains. With more and more companies looking to reduce their carbon footprint and be more responsible toward the environment, the SCF linked to sustainability emerges as an innovative solution.

Scope 3 emissions (generated indirectly by the supply chain) represent one of the biggest challenges for companies looking to become more sustainable. Although these emissions are particularly difficult to quantify due to the lack of reliable data, their identification is critical to setting realistic reduction targets.

Therefore, collaboration between companies and suppliers is essential. According to Marina Andrés, Global Head of Advisory Global Transaction Banking at BBVA, "Lines of action are on the horizon such as the adoption of clean technologies or the search for alternatives with a lower carbon footprint that promote this more sustainable approach. Accounts payable financing linked to sustainability stands as a very effective tool. By offering financial incentives to suppliers who demonstrate a real commitment to sustainability, companies can make a positive impact across their value chain. At BBVA, we promote this type of supply chain finance to help our clients achieve their emission reduction goals."