BBVA Global Markets Quantitative Investment Strategies & Index Solutions

Thanks to our best-in-class analysis capabilities, we deep dive into the most relevant market trends and factors, assessing them from both quantitative and fundamental perspectives to identify their value drivers, and integrating them at the core of the methodology of our indices.

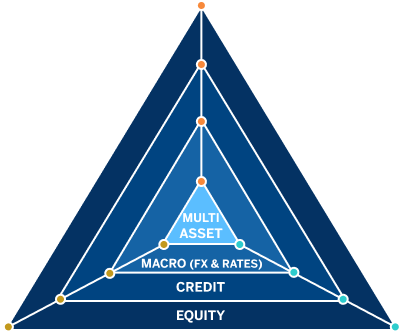

BBVA GM QIS indices can be classified into the following categories, based on the underlying investment idea and investment purpose: Alternative Risk Premia, Thematic & Smart Beta Investing, Fundamental Factor-based.

Enhanced Beta

Additionally, our Index Solutions Framework enables clients to access baskets of indices or instruments across different asset classes to express investment views.

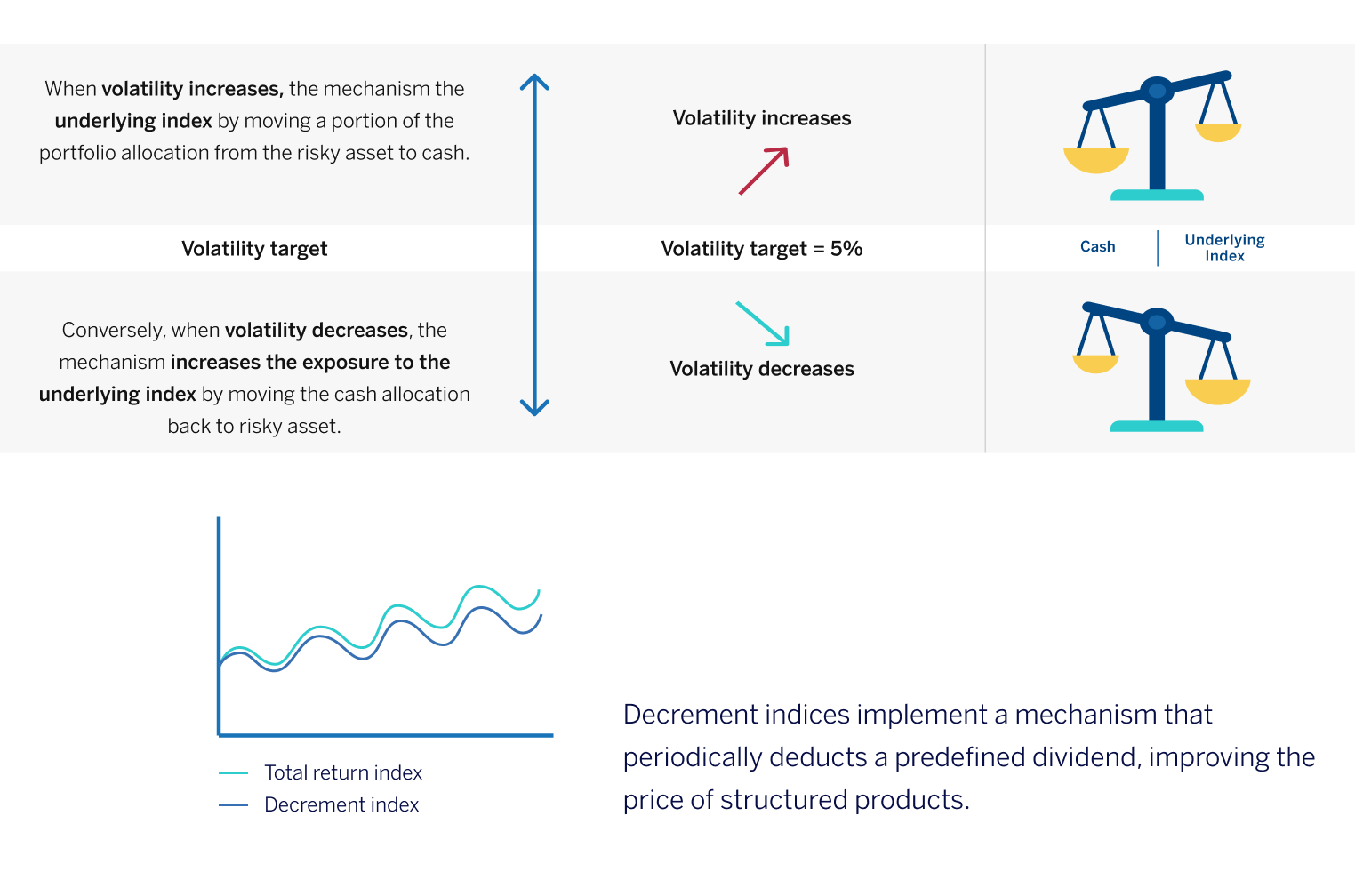

BBVA GM QIS has designed Risk Control and Decrement mechanisms that keeps volatility and dividend parameters at predetermined levels. This way, investors can protect themselves against high volatile market conditions and increase their participation in growth structured products.

Risk control indices are designed to keep volatility and dividend parameters at predetermined levels. They adjust dynamically their exposure to the underlying index (risky asset) depending on the market realised volatility level.

- Dividend expectations do not affect product price

- They can increase participation in growth structured products

- Fully transparent, rules-based and simple

- They reduce the option price by predetermining the variables that most affect it

This website has been prepared by Banco Bilbao Vizcaya Argentaria, S.A. (together with its affiliates, “BBVA”) for information purposes only. BBVA makes no representations or warranties, either explicit or implicit, as to the accuracy, reliability or completeness of the matters stated in this website.

It is not possible to invest directly in an index. Exposure to assets or strategies represented by the relevant Index is made through the entry into of, or the acquisition of (as applicable), any transaction or financial instrument, product or investment (each, a “Product”) that at any time may be related or linked to, based on, developed in connection with, or may otherwise use or track the relevant Index. BBVA does not endorse or make any representation or warranty, express or implied, in connection with any transaction or any Product that references the relevant index including as to the advisability of purchasing or entering into a Product or the results to be obtained by any party using the relevant index in connection with a Product. This website contains no provisions relating to any Product. Furthermore, BBVA has no obligation or liability in connection with the administration, marketing or trading of any such Product. The conclusion of any transaction with BBVA (if any) is subject to BBVA internal approvals and formal agreement, none of which is (or shall be deemed to be) given in, or contemplated by, this website. All statements, information and data in this website are provided for information purposes and shall not in any case be deemed to constitute an offer, invitation, solicitation, investment advice or a recommendation to adopt any investment strategy, to enter into any transaction or to trade, nor shall they form the basis of any contract, commitment or investment decision of any kind.

During the course of its businesses, BBVA may enter into or promote, offer or sell Products that may be related or linked to, based on, developed in connection with, or may otherwise use or track the relevant index. In addition, BBVA may have, or may have had, interests or positions, or may buy, sell or otherwise trade positions in or relating to the relevant index or any of its components or may invest or engage in transactions with other persons, or on behalf of such persons, relating to any of these. Such activity could have an impact, positive or negative, on the level of the relevant index. BBVA does not have any duty (a) to consider the circumstances of any person when participating in such transactions or (b) to conduct themselves in a manner that is favourable to anyone with exposure to the relevant index.

BBVA may act in a number of different capacities in relation to the index and/or Products, which may include, but not be limited to, acting as market-maker, issuer or offeror, hedging counterparty, index administrator and index calculation agent. Such activities could result in potential conflicts of interest that could influence the price or value of a Product. BBVA has policies and procedures to identify, consider and manage potential conflicts of interest that may arise in such circumstances.

This website and all of the information contained in it, including without limitation all text, data, graphs, charts (collectively, the “Information”) is the property of BBVA and/or its licensors, direct or indirect suppliers or any third party involved in making or compiling any Information (collectively, with BBVA, the “Information Providers”) and is provided for informational purposes only. The Information may not be modified, reverse-engineered, reproduced or redisseminated in whole or in part without prior written permission from BBVA. All rights in the Information are reserved by BBVA and/or its Information Providers.

Historical performance of the relevant index should not be taken as an indication of future performance, and no assurance can be given as to the levels or performance of the relevant Index on a future date. Past performance may be simulated past performance (including back-testing) which may involve the relevant index methodology adjustments where necessary. In calculating hypothetical back-tested Index levels, BBVA may have used its own internal models and calculation methods or applied disruption or other provisions specified in the relevant methodologies differently than it otherwise would have applied such provisions in a “live” calculation scenario.

This website or any of its contents do not constitute investment advice, legal advice, tax advice or personal recommendation. Before contracting any Product relating to the relevant index, you should evaluate based on your personal circumstances the financial, market, legal, regulatory, credit, tax and accounting risks, the merits and the terms and conditions and consequences involved of exposure to the relevant index and any related Product and consult your own advisors. BBVA is not providing any such advice.

BBVA makes no representation whatsoever, whether express or implied, as to the suitability for you of the relevant Index to track relevant markets’ performances, or otherwise relating to the index or any Product with respect thereto, or of assuming any risks in connection therewith. The relevant Index may be derived from sources, including market prices, data and other information, that are considered reliable, but BBVA does not warrant their completeness or accuracy or any other information furnished in connection with the relevant Index.

BBVA does not guarantee that there will be no errors or omissions in the calculation or publication of the indices. BBVA shall not have any liability for any such errors or omissions, but will use commercially reasonable endeavours to correct any that occur. BBVA has no obligation to point out errors in the index to third parties including but not limited to investors and/or financial intermediaries in respect of any Product linked thereto. Neither publication of the Index by BBVA nor the licensing of the Index for its use in connection with any financial Product constitutes a recommendation by BBVA to invest in such a financial Product.

BBVA reserves the right to amend or adjust the relevant methodology from time to time in accordance with the rules governing the relevant Index and accepts no liability for any such amendment or adjustment.

BBVA is not under any obligation to continue the calculation, publication or dissemination of the Indices and accept no liability for any suspension, interruption or cessation in the calculation thereof which is made in accordance with the rules governing those. Therefore, BBVA reserves the right to terminate the relevant Index at any moment. Users of the Indices should ensure that they have put in place their own fallbacks and contingency provisions in the event any of the Indices are not available or in case of index discontinuation or in the event that there is a change to the relevant Index that results in it no longer being suitable for the users.

In addition to indices administered, calculated and published by BBVA, the website may include information on indices or benchmarks provided by third party providers (the “Third-Party Indices”). Those Third-Party Indices are not calculated, administered or published by BBVA. BBVA does not act as an administrator or a contributor of such indices. BBVA does not offer any express or implicit guarantee or assurance with regard to the calculation, publication or results of using those indices and/or indices trade mark of the indices prices or levels at any time or in any other respect. BBVA is not responsible for those indices in any case.

The methodology of and rules governing the relevant Index are proprietary and may not be disclosed or disseminated without the permission of BBVA. The use of Indices may be subject to licensing restrictions. A license may be required from BBVA to use, display, create derivatives works of and/or develop or create any transaction and/or distribute any product or service that uses, is based on, and/or developed and/or refers to any indices and/ or index data owned by BBVA. BBVA does not sponsor, endorse, sell or promote any transaction and makes no representation regarding the advisability of investing in any such transaction.

BBVA does not accept any liability for any action taken by you or any third party in reliance on the matters stated in this website, nor for any direct or indirect damage, cost or loss of any nature whatsoever arising out of any error or inaccuracy in it, for any determination made or anything done (or omitted to be determined or done) in respect of any index or any use to which any person may put the relevant index or the levels of the relevant Index in any Product. This Document is not intended for distribution to, or to be used by, any person or entity in any jurisdiction or country which distribution or use would be contrary to law or regulation.

If you are a U.S. person (as defined in Regulation S under the Securities Act of 1933), the information presented here is provided to you by BBVA Securities Inc. (hereinafter, “BSI”), the U.S. broker-dealer of the BBVA Group. You should directly contact your representative at BSI for further information should you have any questions. Under section 871(m) of the IRS, trading on U.S. underlyings could be restricted.

Certain sections, links or pages of the website may contain separate and/or additional statements, data or information which supplement statements, data or information contained in this home page. In the event of a contradiction, the separate and/or additional information shall prevail over the content herein.

No part of this website may be (i) copied, photocopied or duplicated by any other form or means, (ii) redistributed, or (iii) quoted, without the prior written consent of BBVA. It is understood that you accept all of the warnings and conditions contained herein in its entirety.