Green and Social Bond Bulletin

27 January, 2026

Welcome to Green and Social Bond Bulletin.

For another month, we are back with the latest Green, Social and Sustainable Bonds news, a summary of the most recent transactions and market statistics. Enhance your ESG strategy with our professionals’ knowledge. If you would like more information, please do not hesitate to contact us.

TOP DEALS

Gasunie

EUR 750 Mn

Green Senior Unsecured Bond

Telefónica

EUR 11,8 Bn

Green Hybrid

Riyad Bank

USD 1 Bn

Sustainability T2 Bond

Green, Social & Sustainable Bond Issuance Stats

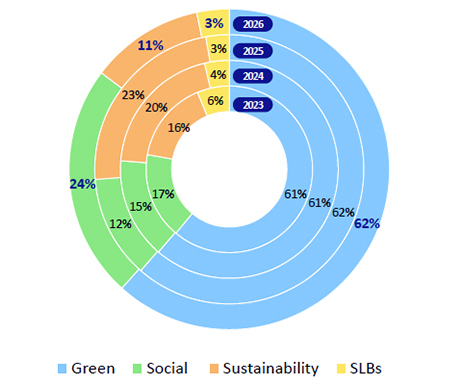

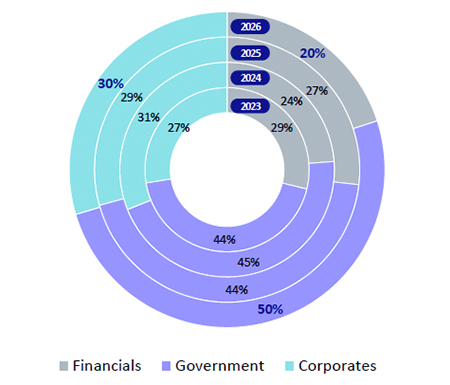

ESG Bond primary market breakdown

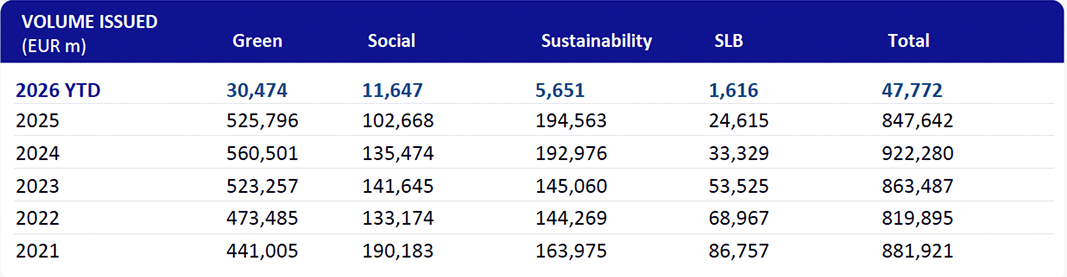

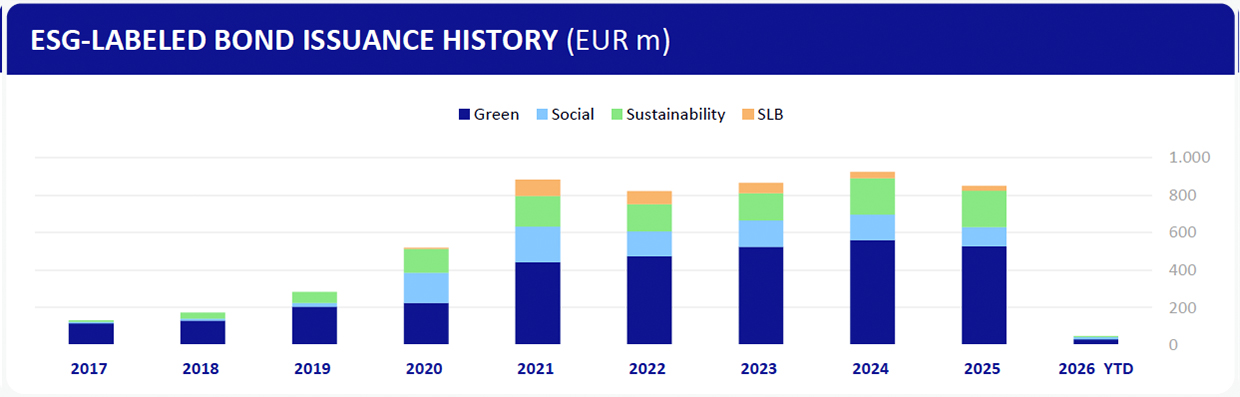

ESG-Labeled Bond issuance history

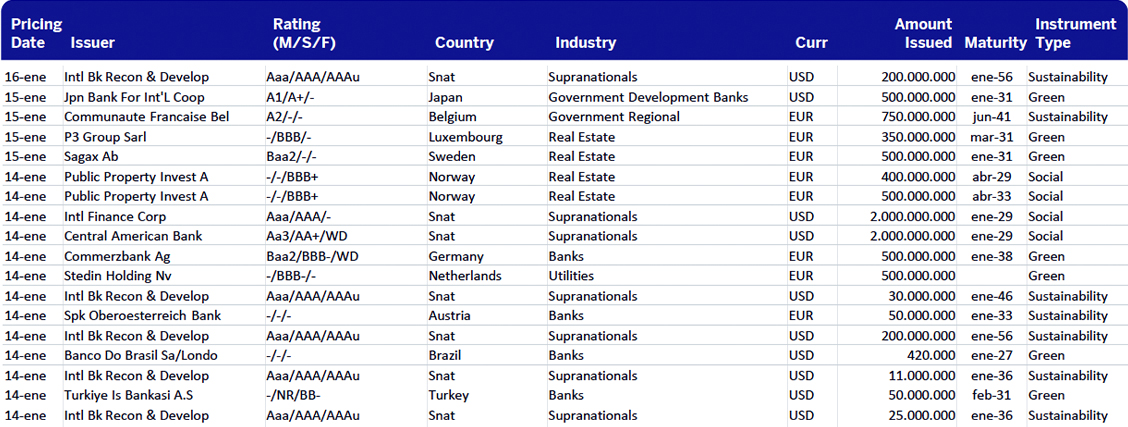

Selected ESG-Labeled Bond Issuance | Recent Deals

For further information or help on the website, please contact our BBVA CIB Marketing department or the Debt Capital Markets team:

Banco Bilbao Vizcaya Argentaria, S.A. nor any of its affiliates (hereinafter “BBVA”) make no representations or warranties, either explicit or implied, as to the accuracy, reliability or completeness of the matters stated in this marketing communication (hereinafter the “Document”). All statements, information and data in this Document are merely indicative and subject to change without notice and shall not in any case be deemed to constitute investment advice or a recommendation to enter into any transaction or to trade, nor shall they form the basis of any contract, commitment or investment decision of any kind. The performance by BBVA of any of the tasks mentioned in this Document is conditional upon all of the definitive legal documentation being entered into between itself and a potential client, and BBVA having access to any of the third party platforms or services mentioned in it. BBVA does not accept any liability for any action taken by you or any third party in reliance on the matters stated in this Document, nor for any direct or indirect damage, cost or loss of any nature whatsoever arising out of any error or inaccuracy in it. No part of this Document may be (i) copied, photocopied or duplicated by any other form or means (ii) redistributed or (iii) quoted, without the prior written consent of BBVA. It is understood that you accept all of the warnings and conditions contained herein in its integrity